PayPal and Stripe are the most prominent payment processing software. Both have similarities but are suited for different business requirements. PayPal is better suited for new or small businesses whereas Stripe is better for big companies because it comes with multiple payment customization options. But which one is better for your needs? Here, we will make a detailed comparison of PayPal and Stripe to find the best payment platform for your business.

PayPal vs Stripe: Overview

PayPal and Stripe are payment platforms that you can use for accepting and receiving payments. With these platforms, you can process payments, transfer money online, and receive payments in different currencies. However, they do have some differences.

For example, Stripe offers more integration options than PayPal. Manual card entry transactions cost is higher in PayPal than in Stripe. Moreover, online transaction costs are higher with PayPal than with Stripe.

PayPal vs Stripe: Pros and Cons

- Refund fees option is not available in Stripe

- Manual card entry transaction rate is higher in PayPal as compared to Stripe

- Recurring payments fee is higher in PayPal than in Stripe

- In-person transaction charge is lower in Stripe than in PayPal

PayPal and Stripe: In terms of Features

Despite sharing some common features, PayPal and Stripe do have some differences in terms of features as enumerated below:

- Pay Later Options: This feature is currently available in both PayPal and Stripe. However, in Stripe it is available via third party integration and in PayPal, it is provided as a built-in functionality. Many PayPal alternatives also offer pay later options.

- Customizability: With Stripe, you can customize the checkout gateway without any extra costs. You will find many Stripe alternatives that let you customize the checkout gateway. Whereas PayPal lets you customize on-site checkout options and the checkout gateway with any additional cost.

- Currencies Supported: For accepting and receiving payments, both these payment gateways support various international currencies. In PayPal, you can process a transaction in 24 currencies whereas 135+ currencies are supported by Stripe.

- Keyed Transactions: These types of transactions can be processed with both Stripe and PayPal but have different transaction rates. PayPal has a rate of 3.49% with a fixed fee of 9 cents whereas Stripe has a transaction fee of 2.9% with a 30 cents fee.

- Chip Transaction Fees: Stripe has a chip transaction rate of 2.9% with a 30 cents fixed fee. On the contrary, PayPal has a much lower rate of 2.29% with a fixed fee of 9 cents.

- Chargeback Fees: The chargeback fee is charged by both PayPal and Stripe with different rates. PayPal has a chargeback fee of $20 whereas Stripe charges $15 per transaction.

- Supported Countries: PayPal can be used in 200+countries and Stripe is only available in 46 countries for international payments.

PayPal vs Stripe: Customer Support

Both PayPal and Stripe offer multiple options to support their customers and address queries. With PayPal, you can connect with the customer support team via message, phone call, and email. Additionally, it offers a FAQ section and community support to get help with general queries.

Compared to PayPal, Stripe also provides message, email, and phone support to connect with customers. Moreover, it also has a resource section and a live chat feature that puts it one step ahead of PayPal.

PayPal vs Stripe: Payment Methods

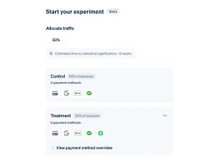

In terms of payment methods, Stripe clearly wins over PayPal. Stripe lets you accept and receive payments through eight different methods including vouchers, wallets, bank debit, buy now pay later, etc. Whereas PayPal supports only five payment methods including credit and debit card, instant bank transfer, etc. If you need a payment app that provides multiple payment options, then Stripe is better.

PayPal and Stripe: Operating Systems

Both PayPal and Stripe can be used on multiple operating systems, however, the number of supported OS may vary. If you want a payment platform that supports Windows, Android, MacOS and iOS, then PayPal is a better choice. Whereas, Stripe can only work on macOS, Linux, and Windows operating systems. PayPal is a clear winner here because it supports more operating systems.

PayPal and Stripe: Pricing

Stripe does not have any pricing tiers and charges customers on a per transaction basis. Its add-on features cost an additional per transaction charge. Also, Stripe does not provide custom fee packages.

PayPal on the other hand, offers two paid plans for customizing shopping flows and using all other features, whereas customization is free in Stripe. Therefore, instead of incurring monthly premium payment to access the features, Strips only charges per transaction fee without any premium subscription.

PayPal vs Stripe: Which is Better?

PayPal and Stripe are popular payment processing software that you can use for accepting and receiving payments online. However, which one is better totally depends on the features you want in that software. PayPal can be a better choice if you want a refund fee option, lower chip transaction rate, multiple payment methods, and a built-in pay later feature. Whereas go for Stripe, if you need 135+ currencies for payment, lower chargeback fee, and free software customization options.

12 Ratings & 11 Reviews

12 Ratings & 11 Reviews