Get Quote

Get Quote

We make it happen! Get your hands on the best solution based on your needs.

Core Functionalities

Payment Methods

Subscription Management

Administrative Features

Security Features

Integrations Supported

Alerts & Notifications

Have recommended this product

Overall Score

Review this product

Your valuable feedback helps others like you make a better decision.

Pros

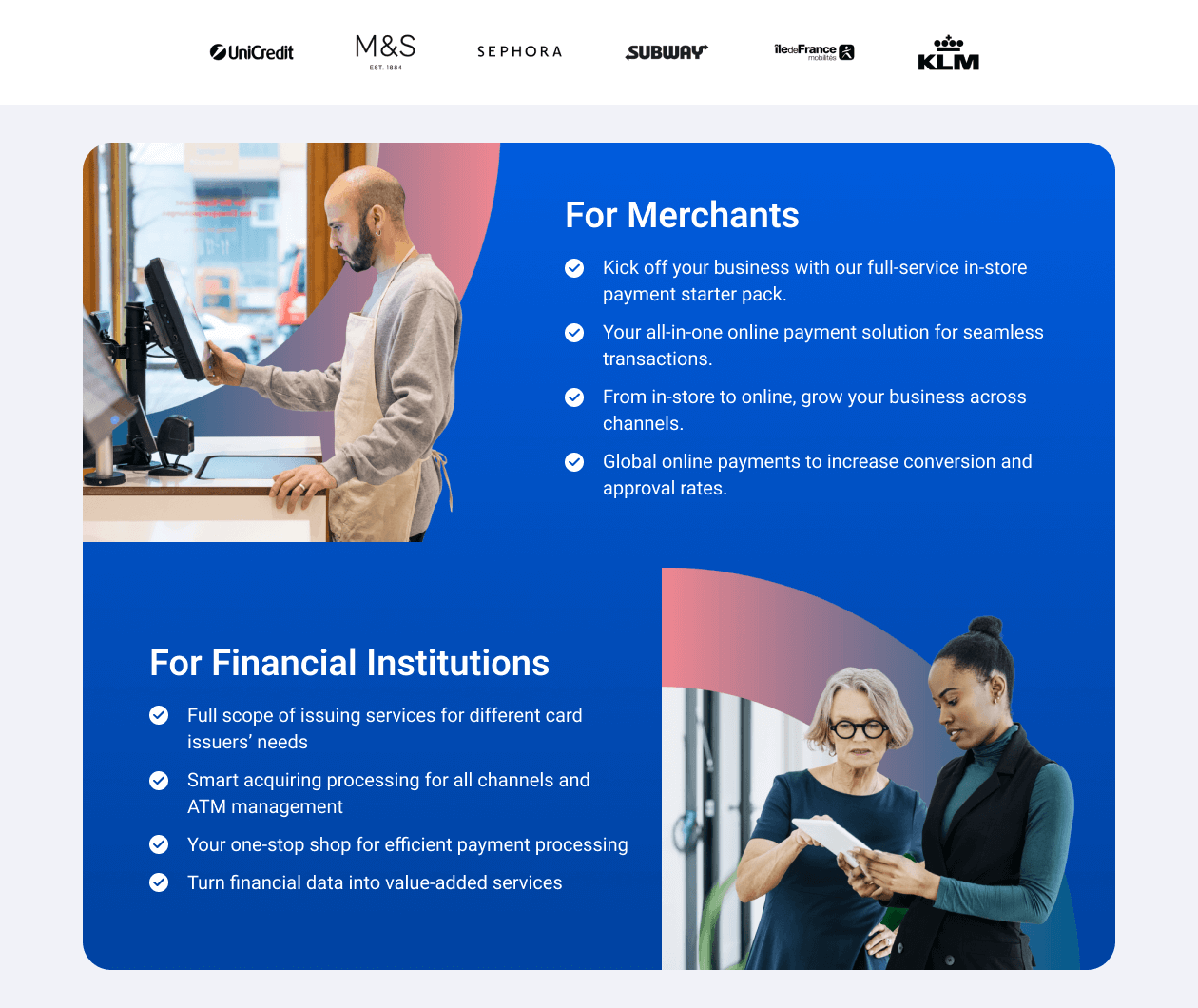

“Worldline has a very user-friendly interface. It’s well-organized with great gateway payment features, suitable for companies of all sizes.” Ashwani Gupta - Aug 5, 2024

“Worldline’s interface is very user-friendly, and it supports various payment modes, making it a good choice for international business.” Hemant Kumar - Aug 5, 2024

“Worldline is a straightforward payment processing company and works well as a payment gateway.” Varun Jain - Aug 5, 2024

Cons

“Sometimes there’s a break in the sync between Bambora and our ERP, but it’s not a dealbreaker.” Nishikanta Samal - Aug 6, 2024

“No significant dislikes. It’s packed with great features and reasonably priced. ” Ashwani Gupta - Aug 5, 2024

“Sometimes there are delays in payment transfers to business accounts, which can be frustrating.” Hemant Kumar - Aug 5, 2024

| Brand Name | Worldline S.A. |

| Information | We are Worldline. We help businesses of all shapes and sizes to accelerate their growth journey – quickly, simply, and securely. |

| Founded Year | 2000 |

| Director/Founders | Worldline |

| Company Size | 1000+ Employees |

To find your API access code in Worldline, follow the steps given below:

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers