Get Quote

Get Quote

We make it happen! Get your hands on the best solution based on your needs.

Core Functionalities

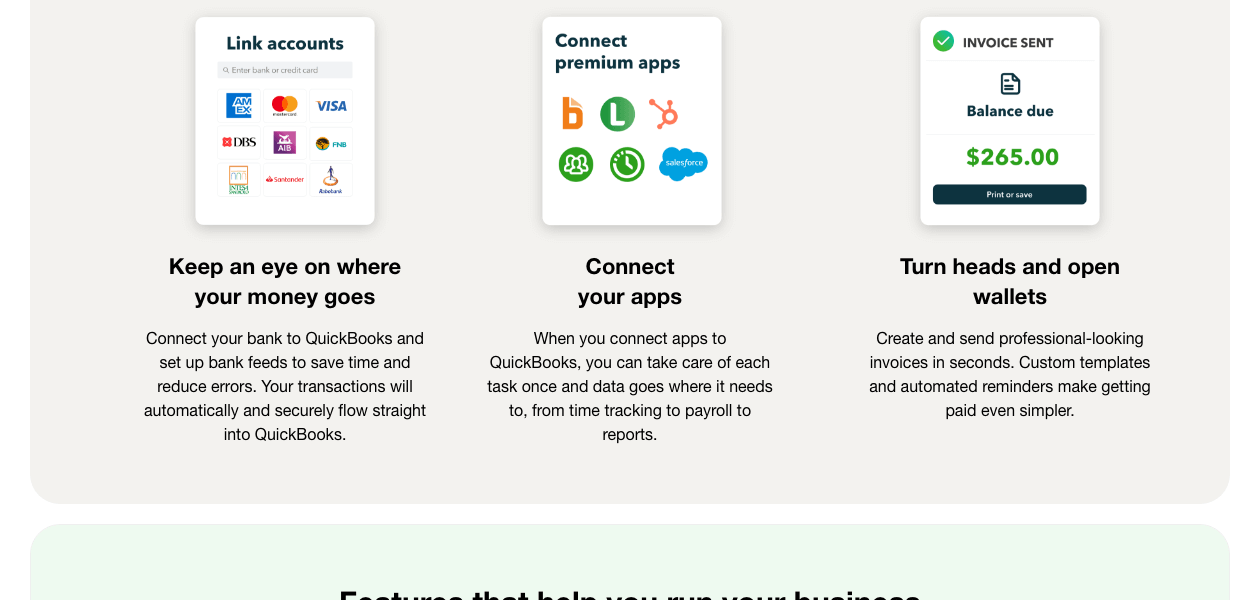

Billing & Invoicing

Retail and Point of Sale

Project and Workflow Management

Inventory and Supply Chain Management

Sales and CRM

Financial Management

Integrations Supported

Analytics and Reporting

Administrative Features

Others

Have recommended this product

Overall Score

Review this product

Your valuable feedback helps others like you make a better decision.

Pros

“You can rely on this application for real-time reporting and cloud based support. Just one click is required for reconciling the gst data and pursue gst filling.” CA GOYAL - Nov 15, 2020

“Because of reconciliation, I can quickly reconcile the books to bank statements.” Mehul Kansara - Jun 6, 2020

“Quickbooks has great Uptime and downtime alerts will be notified as soon as it goes down.” Vishal QA - Aug 20, 2019

Cons

“Small businesses may not be able to manage their work with this application as high-speed internet access is necessary.” CA GOYAL - Nov 15, 2020

“auto gst and igst is not working as per other state purchase and sale” Mehul Kansara - Jun 6, 2020

“Aside from the advantages mentioned above, I am quite unhappy with the support team as we need to wait for hours online waiting to get connected.. ” Rizwin - Apr 21, 2020

| Brand Name | Intuit |

| Information | Intuit is a global technology platform that helps our customers and communities overcome their most important financial challenges. |

| Founded Year | 1983 |

| Director/Founders | Scott Cook, Tom Proulx |

| Company Size | 1000+ Employees |

| Other Products | Turbotax Tax Filling Software, Quickbooks GoPayment, QuickBooks Payroll |

QuickBooks is one of the popular accounting solutions designed for businesses to manage their financial processes easily. Listed below are some of the reasons that make QuickBooks the best accounting platform for users:

User-friendly interface

Seamless integration with various third-party apps

Suitable for all business sizes from small-scale to medium-sized and enterprise level

QuickBooks can be easily accessed from anywhere

It offers many advanced features, including expense tracking, tax preparation, and detailed reporting

Top Selling Products

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers