Get Quote

We make it happen! Get your hands on the best solution based on your needs.

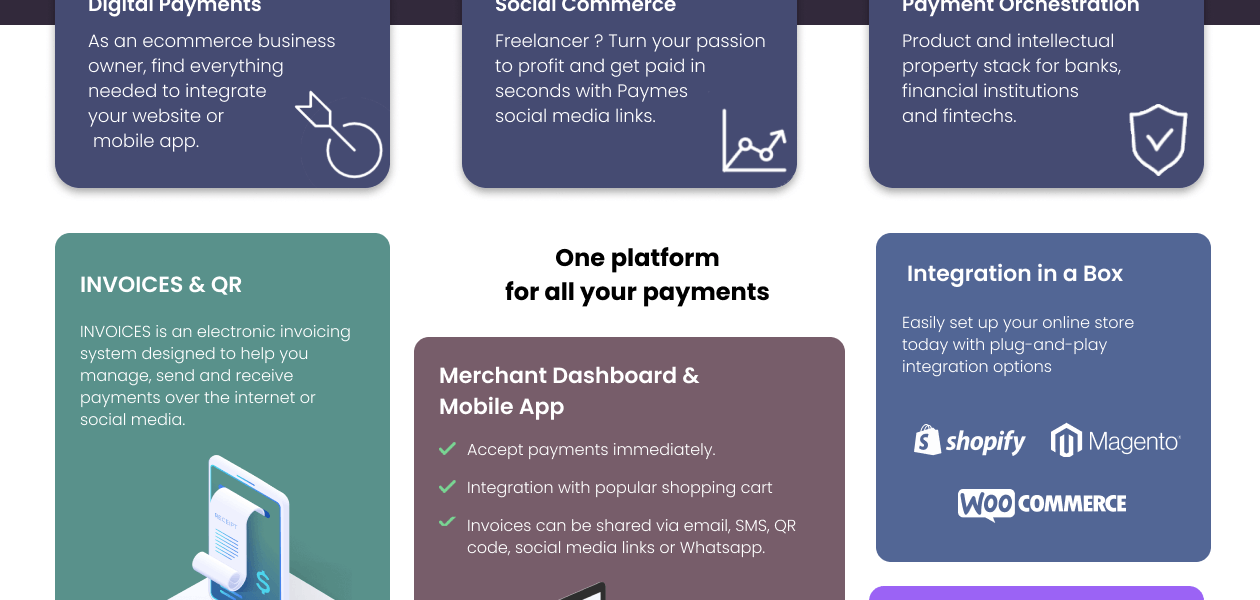

Core Functionalities

Payment Methods

Subscription Management

Administrative Features

Security Features

Integrations Supported

Alerts & Notifications

Have recommended this product

Overall Score

Review this product

Your valuable feedback helps others like you make a better decision.

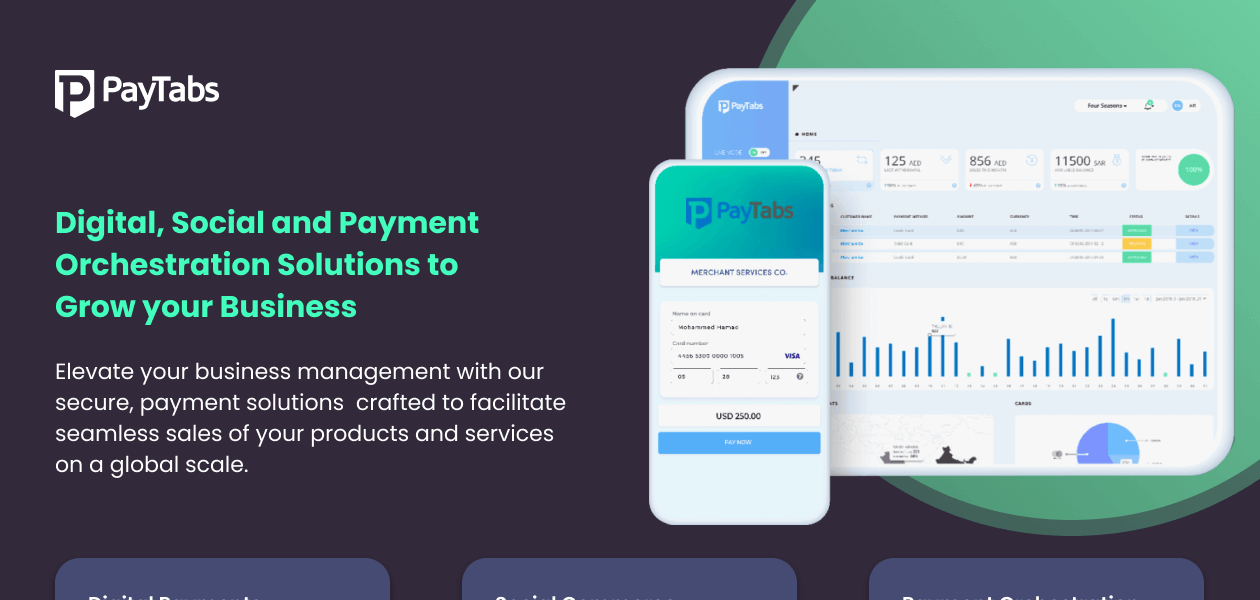

| Brand Name | Paytabs |

| Information | PayTabs is an online, mobile, social & next generation payment processing powerhouse for merchants & super merchants to grow their business. |

| Founded Year | 2014 |

| Director/Founders | Abdulaziz Fahad Al Jouf |

| Company Size | 101-500 Employees |

Usually, the documents that are required to apply for a PayTabs account are a government-issued ID, proof of address, bank account details, and a commercial registration certificate (depending on your business structure). Depending on your region, additional KYC documents such as a tax card or MOA may also be required.

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers