Payflow Software Pricing, Features & Reviews

What is Payflow Payment Gateway?

Payflow Payment Gateway is a comprehensive solution for businesses to manage their online payment transactions securely and efficiently. It supports a variety of payment methods, including credit/debit cards, PayPal, and PayPal Credit, providing a seamless payment experience for your customers.

Its intuitive dashboard offers a detailed overview of your transactions, helping you track and manage payments effortlessly. Its user-friendly interface ensures easy navigation, making it convenient for businesses to integrate and utilize the gateway effectively.

One of the unique features of Payflow is its global reach, supporting payments in 25 currencies across 202 countries. It also offers customizable payment options, enabling you to create a tailored payment experience that aligns with your brand.

Why Choose PayPal Payment Gateway?

Payflow by PayPal stands out for its robust security measures, extensive payment method support, and easy integration. Here are the key reasons why users choose Payflow payment gateway:

- Built-in Buyer and Seller Protection: It offers protection programs for both buyers and sellers, adding an extra layer of security to transactions. This ensures that both parties are safeguarded against potential disputes or fraud, enhancing trust and reliability.

- Seamless Integration & Setup: Payflow payment gateway offers straightforward integration options with comprehensive documentation and SDKs, making setup quick and hassle-free.

- Global Acceptance: Payflow by PayPal supports a wide range of payment methods and currencies, enabling businesses to reach customers worldwide.

- Robust Security: With advanced fraud protection tools and PCI compliance, Payflow ensures that transactions are secure and reliable.

- Flexible Integration: Payflow offers easy integration with various e-commerce platforms and shopping carts, making it simple for businesses to implement.

- Customizable Payment Solutions: Businesses can customize their checkout experience and payment options to suit their specific needs and preferences.

- Comprehensive Reporting: Detailed reporting and analytics tools help businesses monitor transaction activity, manage cash flow, and make informed decisions.

- 24/7 Customer Support: Payflow provides round-the-clock customer support to assist with any issues or questions, ensuring smooth operation of the payment gateway.

Additional Features of Payflow Payment Gateway

Payflowl offers a range of advanced features to streamline your payment processing tasks. These include:

- PayPal and PayPal Credit Integration: Payflow seamlessly integrates with PayPal Credit, allowing customers to make payments using credit options provided by PayPal. This flexibility can increase purchasing power and convenience for customers.

- Fund Freezing for Fraud Protection: To combat fraud, PayPal payment gateway can hold or freeze funds for up to 21 days if suspicious activity is detected. This proactive measure helps protect both merchants and customers from fraudulent transactions.

- Hosted Checkout Pages: Payflow also provides hosted checkout pages to ensure data security during transactions. By handling sensitive payment information on PayPal’s secure servers, merchants can offer a safer checkout experience for their customers.

- Payflow Carding Module: The Payflow carding module is a specialized fraud prevention tool within the Payflow payment gateway. It helps merchants combat carding, a type of credit card fraud, by detecting and preventing unauthorized transactions.

- Affordable Transaction Costs: Using PayPal's Payflow service costs just $0.10 per transaction. This low fee makes it a cost-effective option for businesses of all sizes, helping to keep operational costs down.

- Card on File: This payment gateway allows merchants to store customer payment credentials for future transactions. This feature simplifies repeat purchases, making it easier and faster for customers to complete transactions.

- Buyer Authentication: Payflow offers an additional security layer called buyer authentication. This feature verifies the cardholder’s identity during online purchases, helping to prevent unauthorized transactions and enhance security.

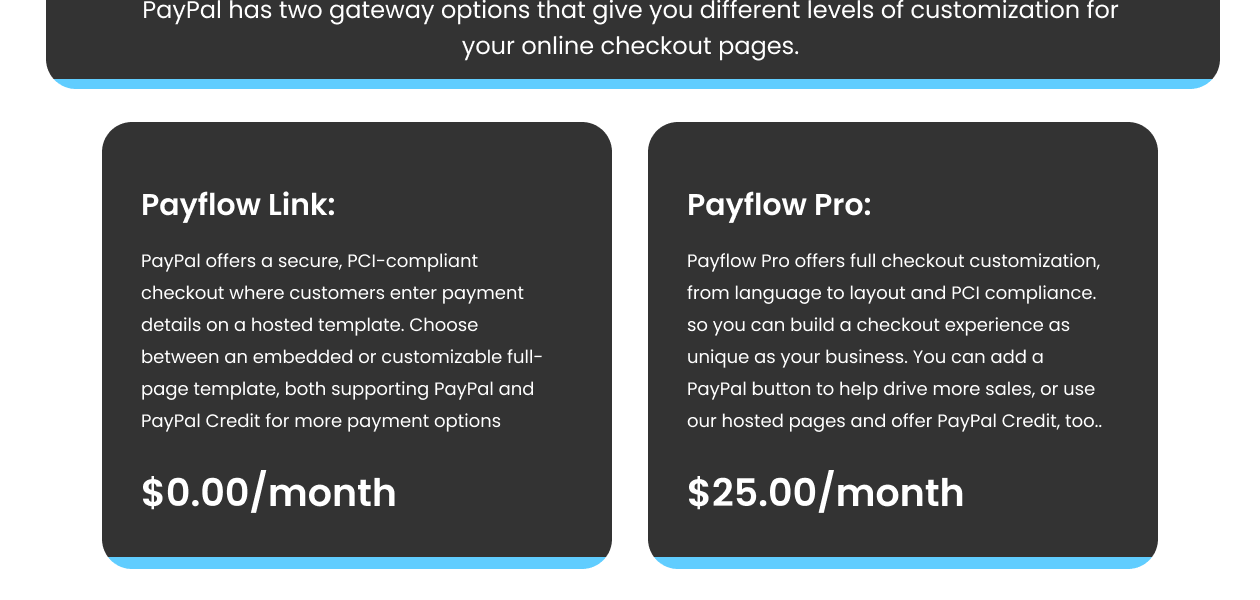

Pricing of Payflow payment Gateway

PayPal payment gateway charges 4.40% plus a small fixed fee for international transactions. Micropayments have a 6.00% fee plus a fixed fee depending on the currency. There are also extra fees for disputes, currency conversions, and some other transactions.

“Transactions are processed quickly, which is essential for a smooth customer experience.” Poonam - Aug 14, 2024

“Offers a good balance of affordability and functionality. Ideal for budget-conscious businesses.” Usha Yadav - Aug 14, 2024

“Impressive security features make it a top choice for safeguarding transactions.” Sachin Kaushal - Aug 13, 2024

“The interface can be a bit clunky and less intuitive than other options. ” Sachin Kaushal - Aug 13, 2024

“The customization options can be overwhelming if you’re not tech-savvy. ” Pihu Mehra - Aug 5, 2024

“It offers only basic features, which may not meet all advanced needs. ” Ishika Bisht - Aug 4, 2024

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers