KeyStocks Lite Software Pricing, Features & Reviews

What is KeyStocks Lite?

KeyStocks Lite is a premium technical analysis software for stock traders. It is a comprehensive stock market research tool used by traders for making better buy & sell decisions. It contains hundreds of metrics, tools, and options to track value, performance, and returns on any equity, commodity, currency, or market.

KeyStocks Lite market research tool helps monitor the share market trend in real time. This stock market software for technical analysis comes with pre-installed charting and graphical tools that will keep tabs on all relevant data and information related to your potential stock portfolio. KeyStocks screener helps every investor make trading decisions based on real-time data, accurate metrics, and trends.

KeyStocks Lite stock screening software helps to track multiple sectors efficiently at the same time by using live price feeds that are automatically updated in real-time. It helps generate accurate buy/sell signals that are represented on the trader's computer screen. KeyStocks app and software play a crucial role whenever there is a need to come up with a complicated trading strategy with the help of machine learning. However, it cannot be downloaded for free, one can contact techjockey.com for further details.

System Requirements: Min. 2GB Disk Space, 4GB RAM, i3 & higher processor

Operating Systems: Windows-7, 8, 10, & 11(only works with Windows OS)

Key Functionalities of KeyStocks Lite

- Stock Analysis: Offers advanced tools and indicators for in-depth market analysis, allowing users to track stock performance, monitor trends, and identify potential opportunities.

- Watchlist Management: Users can create and manage personalized watchlists to keep track of their favorite stocks, track price movements, and receive real-time alerts.

- Portfolio Tracking: Enables users to monitor their investment portfolios in one place, providing insights into performance, asset allocation, and overall profitability.

- Fundamental and Technical Analysis: The software incorporates both fundamental and technical analysis tools for stock traders, empowering users to evaluate company financials, study charts, and utilize key metrics to make informed investment decisions.

- News and Market Insights: KeyStocks Lite provides timely news updates, market analysis, and expert insights to keep users well-informed about market trends and events that may impact their investment strategies.

How to Install KeyStocks Lite Software?

To install KeyStocks Lite, follow these simple steps:

- Visit the official KeyStocks website.

- Navigate to the Downloads section.

- Locate the KeyStocks Lite software and click on the Download button.

- Once the download is complete, run the installation file.

- Follow the on-screen instructions to complete the installation process.

- Launch the KeyStocks Lite software and begin exploring its features.

Why Choose KeyStocks Lite?

KeyStocks Lite offers a range of advantages that make it an ideal choice for stock market enthusiasts:

- Ease of Use: With its user-friendly interface and simplified features, it is accessible to both novice and experienced investors.

- Comprehensive Analysis: The software provides a comprehensive set of tools and features for analyzing stocks, from advanced technical indicators to fundamental data, enabling users to make well-informed investment decisions.

- Personalization: It allows users to customize their experience by creating personalized watchlists, setting alerts, and accessing relevant news and insights tailored to their interests.

- Cost-effective: It is available as free software, making it a cost-effective option for individuals looking to enhance their stock market analysis capabilities without incurring additional expenses.

Benefits of using KeyStocks Lite Software

The key benefits of using KeyStocks technical analysis software are given below:

- Provides an overview of any portfolio, stocks, commodity, currency, or market's performance by taking overall statistics into account.

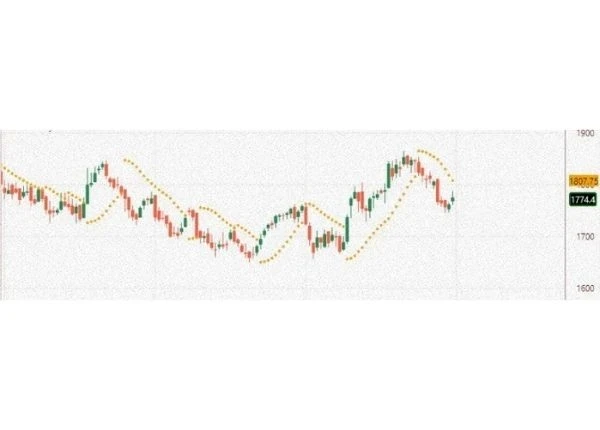

- In-depth analysis of stock by graphical representation of metrics like Moving Average, Trendline scan, Wolfe Wave, etc.

- KeyStock allows traders to easily search and locate stocks of their choice.

- It indicates the entry signals and gives exit strategies alerts when needed.

- KeyStock technical stock screener allows brokers and traders to make decisions based on trading statistics and analyze their performance.

- It can create triggers based on an indicator that will alert the trader to place a buy or sell order.

- Traders can compare multiple portfolios based on various metrics like risk, return, and trends.

- KeyStocks app helps set alerts, which is helpful for tracking the progress of stocks being traded.

What is KeyStock Used for?

- Scanning Chart Pattern: Boost returns on your portfolio with the powerful chart pattern recognition scanner of KeyStocks Lite. Chart Pattern Scans like double top patterns, triple top patterns, tradeline scans, Flag and Pennant, etc., help professional traders maximize returns.

- Moving Averages Scanning: Moving averages scanner in KeyStocks helps traders focus on long-term trends. It provides traders with a perspective from which they better assess what might happen next. MA Band Scans, Single MA Queries, Crossover, Band Scans, etc., are tools that help traders in stock screening.

- Indicators and Buy Sell Signals: KeyStock lets investors filter out the best stocks with flexible indicators scan. Technical Intraday Indicators like SuperTrend, ATS/SAR, Parabolic SAR, etc., ensure that the parameter on which the trader makes his decisions are well-represented and accurate. It also enables users to set various trigger points on different indicators, which remind traders to buy or sell stocks.

- CandleSticks Pattern Scanner: Candlestick Scanner in KeyStocks is a potent tool that allows traders to create their candlestick pattern for better stock screening. It helps to scan for candlestick patterns, highlight CandleStick practices, and scan candlestick patterns with indicators.

- Important Scans: Stock screening capabilities of KeyStocks are virtually unlimited. Powerful tools such as Breakout Analysis, Scan Divergence, 52 Week High Low pointer, Volume Analysis, etc., provide traders with reliable analytical information.

How Does KeyStocks Lite Work?

The latest version of KeyStocks Lite is primarily used for stock market study, stock screening, and technical analysis. It has an intuitive interface and is simple to use. KeyStocks Lite can be easily integrated with your existing systems to ensure a smooth workflow. For more information, you can also refer to user manuals and take an online KeyStocks Lite demo at Techjockey.com.

KeyStocks Lite Pricing

There are two different versions available with KeyStocks to be purchased:

End-of-Day Version:

Free Trial Available for 2 Weeks

1. Higher Timeframe Charges: (Monthly/weekly/Daily Charts)

- 1 year: Rs. 2000+18% GST

- 2 years: Rs. 3500+18% GST

2. Lower Timeframe Charges: (5 mins to 4 hours along with Monthly/Daily/Weekly timeframe in EOD)

- 1 year: Rs. 2500+18% GST

- 2 years: Rs. 4500+18% GST

Intraday Version:

No free trial available (Paid trial available for a month at Rs.600)

Single System License:

- 1 year: Rs. 5100

- 6 months: Rs. 3000

“The interface is highly intuitive and the learning curve for the software is minimal.” Nitesh - Nov 20, 2023

“When I first started using this software, it was difficult to learn due to its complex interface. So, it is a bit difficult for beginners to learn. ” Rohit Premjani - Feb 19, 2025

“While KeyStocks has an active user community, it may not be as large or diverse as some other trading platforms.” Srishti Srivastava - Nov 27, 2023

“As it is a paid platform, its cost can be prohibitive for some traders.” Anant Tiwary - Nov 24, 2023

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers