Get Quote

Get Quote

We make it happen! Get your hands on the best solution based on your needs.

Core Functionalities

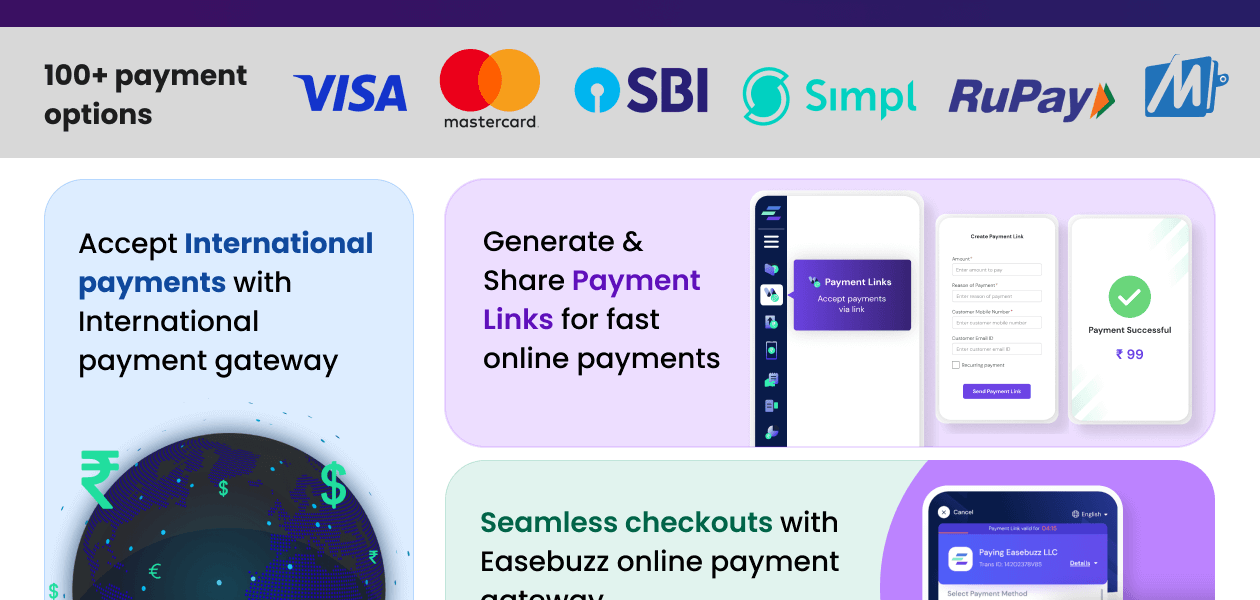

Payment Methods

Subscription Management

Administrative Features

Security Features

Integrations Supported

Alerts & Notifications

Have recommended this product

Overall Score

Review this product

Your valuable feedback helps others like you make a better decision.

Pros

“Payments are processed very quickly. The system is simple and straightforward.” SUNIL KUMAR - Aug 6, 2024

“Payments are secure, keeping your information protected. It's easy for anyone to use.” Janvi Shetty - Aug 1, 2024

“The website and app are straightforward and easy to use. Setting up the account is fast and hassle-free.” Nishant - Aug 1, 2024

Cons

“Lacks advanced analytics tools for detailed transaction insights.” Nishant - Aug 1, 2024

“Customer service can sometimes be unresponsive during peak times.” Nishant Goyal - Jul 17, 2024

“Settlements of the funds can be delayed. However, this does not happen often, but it is a bit of concern.” Nishu Chawla - Jul 10, 2024

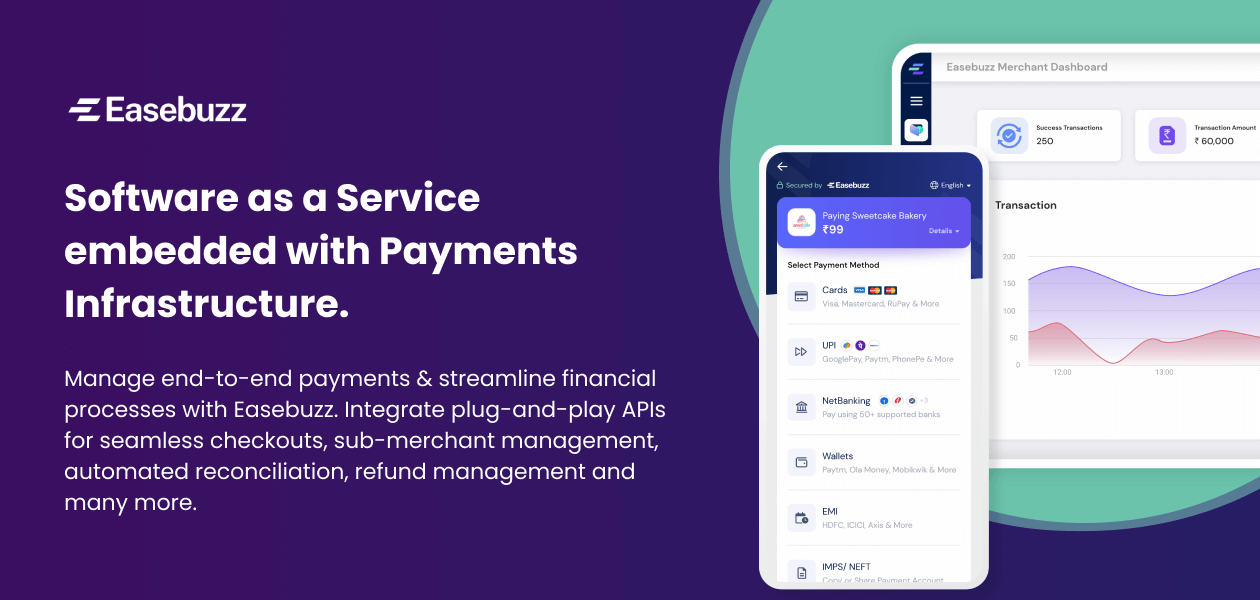

| Brand Name | Easebuzz |

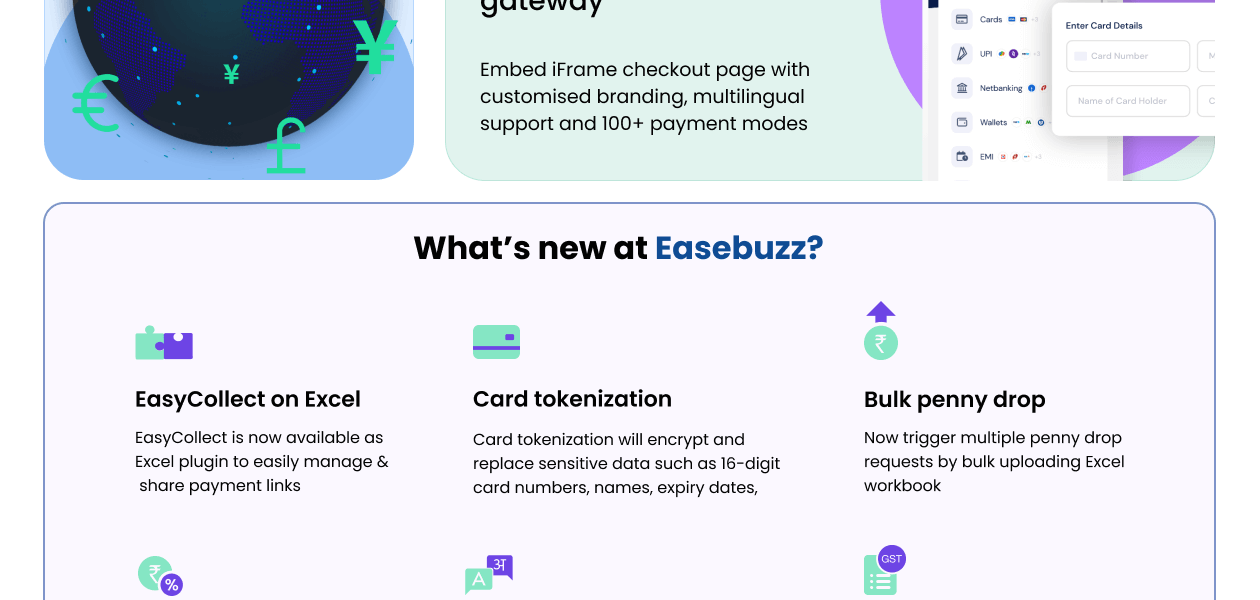

| Information | Easebuzz helps companies digitise payments & manage end-to-end financial operations around digital payment collections, payment disbursals, connected banking, split payments, automated reconciliation, vendor payments, sub-merchant management, refund management etc through plug-and-play API solutions |

| Founded Year | 2021 |

| Director/Founders | Amit Kumar |

| Company Size | 101-500 Employees |

20,000+ Software Listed

Best Price Guaranteed

Free Expert Consultation

2M+ Happy Customers