Proforma Invoice is one of the most crucial documents while trading. Proforma Invoice helps sellers confirm a trade, receive an advance and negotiate deals. On the other hand, it allows buyers to estimate taxes, shipping charges, discounts, etc. In short, quite a popular pre-sales document widely used in the trade and service industry.

Small traders and service providers often have trouble preparing Performa Invoice as there are several factors that accountants and business owners should consider while creating proforma. This article aims to provide every detail related to it along with a widely accepted Performa Invoice Format for GST, which you can easily edit.

What is a Proforma Invoice?

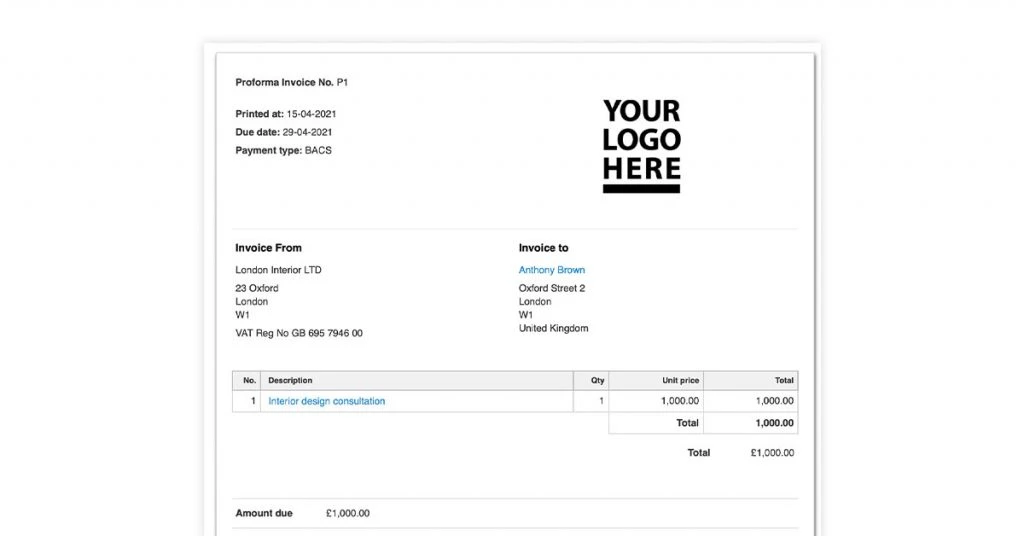

Proforma invoice is a document containing the estimated value of goods or services to be supplied to the buyer. It is similar to a regular tax invoice with “Proforma” being mentioned on top. It is generated for tax calculations, import and export, shipping, receiving payment, confirming the trade, and so on.

Thi includes details regarding buyer, seller, GSTIN, date, the value of products/ services to be supplied, GST charged, etc. This helps companies provide a realistic estimate of the amount that the buyer might need to pay. Some businesses use Performa as quotations, and business owners might even use it to confirm the trade.

Generally, it is prepared using Invoicing Software or Excel. There are thousands of Excel Proforma Invoice templates floating all over the internet, but only a few of them meet industry-accepted standards.

Suggested Read: Proforma Invoice Vs Tax Invoice: What’s the Difference

Why and When to Use a Proforma Invoice?

A Proforma invoice is a document provided to potential buyers regarding sales, receiving payment, and tax calculation.

Tax Calculations: Proforma Invoice helps the buyer get a realistic estimate of GST, import duty, and other taxes.

Receiving Payment: The buyer will typically pay advance for receiving a good/ service based on the value mentioned on the proforma. Besides, proforma is very important for receiving payments from abroad.

Confirming Trade: Sometimes, Proforma is also used to confirm trade as the buyer accepts the estimated cost of goods sold.

Provide Realistic Estimates to the Buyer: Buyers rely for a realistic estimate of their liability. This helps in streamlining the process of payment collection for sellers.

What is Included in Proforma Invoice?

Performa Invoice contains all information of a product or service being sold, cost as well as the amount due for both parties involved in transaction.

Service Provider/ Seller Details

- Name of the Individual/Company

- Phone number

- Address

- Email Id

Customer/Client Details

- Name of Customer/Client

- GSTIN

- Address

- Email ID

- Phone Number

Suggested Read: How to Create Performa Invoice in TallyPrime

Other Payment and Delivery Details

- Purchase Order No.

- Supply date

- Supplier Reference No.

- Dispatch Document No.

- Dispatch Mode

- Terms of Delivery

- Delivery Date

- Mode of Payment

Sales Details

- Performa Invoice Date

- Detailed Description of Products or services to be supplied

- Quantity supplied

- Rate per unit

- Taxes GST, VAT, or Cess

- Discounts if applicable

- Net amount payable by the client or customer.

How to Create a Proforma Invoice?

There are three ways of creating a pro forma invoice in general based on the number of entries and the manual work someone wants to do. Here are the three primary ways of creating a Profoma invoice.

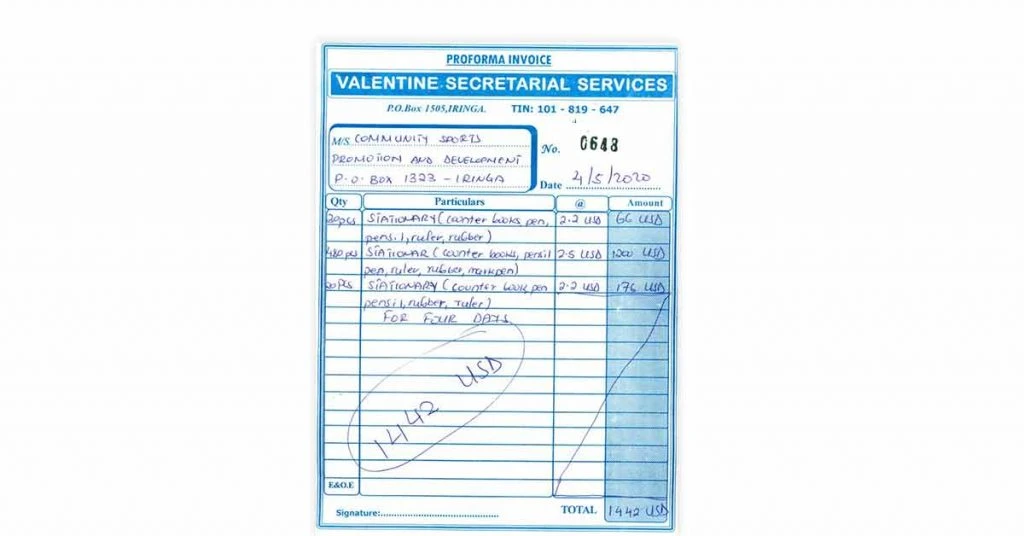

Traditional BillBook Method

This method is also known as the manual bill book method, and it is the oldest way to create Proforma Invoice. This involves paper entry of all information related to the product or service being sold along with costs as per the requirement of the supplier.

Pros of Traditional BillBook Method

- Extremely simple

- No infrastructure required

Cons of Traditional BillBook Method

- Tedious and repetitive

- Prone to human errors

Traditional BillBook Method is Fit for

- Individuals/ Proprietary

- Occasional usage

Although manual bill book was once the only method used to create Proforma Invoice, the advent of electronic invoicing tools made this method almost obsolete.

Suggested Read: Best Sites to Download Free Invoice Templates

Proforma Invoice in Excel

You can also use Excel or Google Sheets to create Proforma. It is extremely easy to make Proforma invoices in Excel, as it allows users to make accurate calculations and regenerate them quickly with minor changes.

There are generally two ways of using Excel or Google sheets to create a Proforma Invoice Online:

Create Custom Performa Invoice Template in Excel: Users can define their fields and create their own Proforma invoice template in excel. However, users need to have a strong command over the tool to utilize the Performa invoice format in Excel.

Use a Prebuilt Excel Performa Invoice Format: One of the easiest ways to create a Proforma Invoice is to download a prebuilt excel format of a Pro forma Invoice and enter all the necessary data and fields.

Steps by Step Guide to Creating Proforma Invoice in Excel Format

Download and open the attached Invoice template option

Enter all details like name of the supplier, customer name, address, GSTIN, email id, etc.

Enter date and invoice number

Then, enter all details like invoice date, amount, tax amount, discount, etc.

Now, either save it as a Proforma invoice template in “xlsx” format or select the required area and print it

You can either send the excel file with Performa invoice directly on the mail or print it as a hard copy or PDF file.

Pros of Making Proforma Invoice in Excel:

- Easy to create, edit and print

- Reduces human errors

- Quick Regeneration for frequent usage

Cons of Using Excel to Make Performa Invoice

- Requires a little technical knowledge in Excel

- Not fit for making medium and large businesses

- Can’t store historical data properly

Performa Invoice in Excel Is Fit for:

- Small businesses with occasional usage

- Self-employed and freelancers

Although Excel is simple and used to create Proforma invoices occasionally, it’s not the most reliable way as there are many gaps in making changes, storing data, updating, converting proforma to the bill, and automated proforma creation.

Suggested Read: Best Free Invoicing Software for Small Businesses

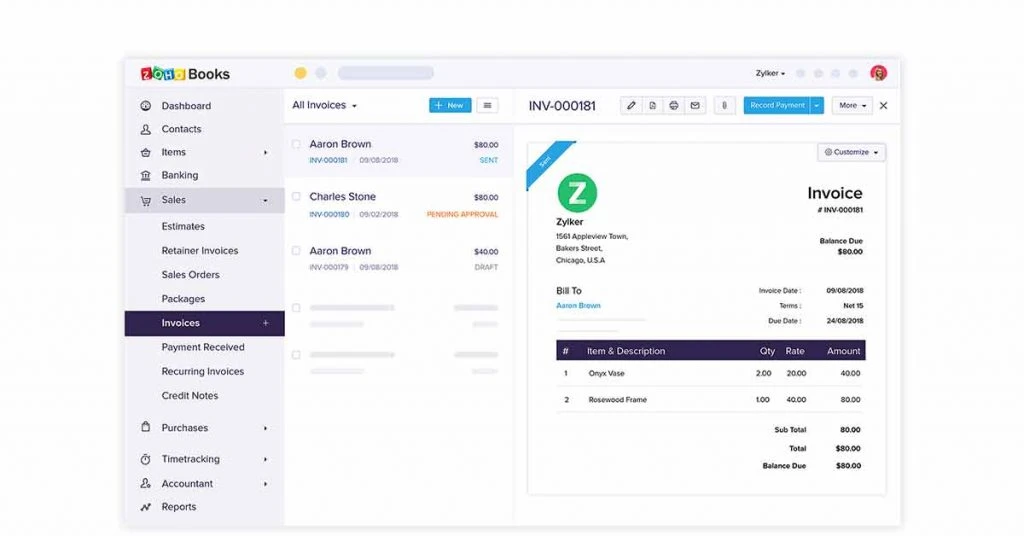

Using Performa Invoice Software

Proforma invoice making software is the best way to create proforma invoices. To create a Proforma Invoice, users just need to enter all the client details and the product, service, and quantity. Accountants need not worry about templates and fields.

Invoicing software has a massive advantage over excel templates while creating it. It provides many features like automation, setting predefined fields, easy update, and storing data in a centralized database.

You can use dedicated invoicing software like SleekBill, MyBillBook, and Vyapaar to create Performa Invoices. This software provides options to enable and disable multiple fields and choose different formats, colors, currency, and templates for Proforma creation.

Pros of Using Invoicing Software

- Industry accepted proforma Invoice Templates and format

- Highly Customizable

- Prefill Client, product, service, rates, and tax details

- Centralized database for storing all data

- Easy to track and update proforma

Cons of Using Proforma Invoice Making Software

- It might be costly for occasional users. (However, there are many free proforma invoice making software like SleekBill)

- Requires basic hands-on training

Proforma Invoice Format for GST

Proforma invoices constitute indirect tax calculations to inform customers about the bill’s precise value and applicable tax. Before the GST era, it used to be VAT, and every Performa Invoice used to have applicable VAT rates and VAT details.

A proper GST Proforma Invoice will include the following details:

- Suppliers GSTIN, name and address

- Validity of the proforma

- Buyer’s name, address, and GSTIN (In case of B2B)

- SAC/ HSN code of Goods or Services to be supplied

- Applicable GST rates and item wise breakdown

- Place and address for supply

Is Proforma Invoice Legally Binding?

Proforma Invoice is not legally binding as it is just an estimate of the cost of goods and services to be supplied. Although the customer may negotiate the price mentioned on it before accepting, it doesn’t raise the obligation for the customer to pay or for the seller to deliver anything.

A Performa invoice becomes legally binding only when converted to an actual invoice. However, the invoice is considered as a reference for payments, delivery, and even to draft contracts.

Suggested Read: Best Free Invoice Generators with Customized Invoice Templates

Difference Between Performa Invoice and Other Invoices

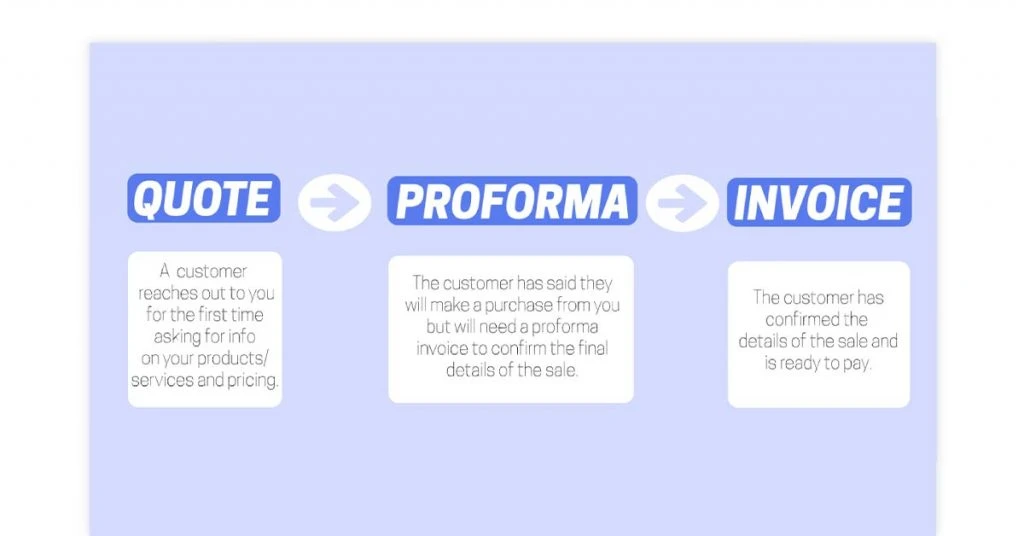

Generally, four types of documents are involved in selling or buying a product. Purchase order, Proforma Invoice, Quotation, and Invoice. Here is the importance of each document in the chronological order.

Purchase Order: A Purchase order is a formal document used by buyers to purchase goods or services from sellers. It is issued by the customer to communicate the requirements to sellers.

Quotation: A quotation is an offer made by a seller for a specific product and service. It is also an estimate and often interchanged with “Performa Invoice.”

Proforma Invoice: Document containing the estimated value of goods or services to be supplied to the buyer along with approximate taxes, discounts, and other charges.

Invoice: Invoices are financial documents that provide delivery and raise the obligation of payment. It includes information about quantities, prices, dates and tax details of the transaction conducted.

Purchase orders and invoices are entirely different from Proforma invoices. A purchase order is issued by the buyer, while proforma is issued by the seller. A proforma invoice is a simple estimate, whereas an invoice is a legally binding document.

However, most people get confused between Proforma Invoice and Quotation and often use them interchangeably.

Pro Forma Invoice Vs Quotations

| Type | Quotations | Proforma |

| Issued By | Seller | Seller |

| Reason to Issue | Sending offers to customers/clients | Giving customers an estimate of the amount payable |

| Time of Issue | Before negotiations of contract | Before the delivery of goods or services |

| Expectation | No payment is expected against the quotation | Issued only when payment is expected |

| Tax Details | May or may not have tax calculations | Includes estimated calculation of GST payable. |

FAQs

Can a proforma invoice be canceled?

Proforma Invoice is not a legally binding document; it doesn't need an official cancellation. A simple communication or issue of another proforma deems cancel the existing Proforma invoice.

What is there in a Proforma Invoice?

Proforma Invoice has an estimate of the amount payable by the buyer for the goods and services to be delivered. It may contain other details of suppliers, buyers, shipping charges, discounts, GSTIN, and taxes payable.

Why are proforma invoices used?

A Proforma invoice is used to provide buyers with an estimate of the total amount payable, along with discount rates, tax, and other charges applicable to goods and services to be delivered.

What is the use of a Proforma Invoice for shipping?

The pro forma invoice contains many details of goods to be delivered, like weight and dimension, which the buyer uses to make shipping arrangements.

Which software can I use to create a proforma invoice?

You can use online invoicing Software like SleekBill or MyBillBook to make Proforma Invoice. You can also use accounting software like Zoho and QuickBooks to create proforma invoices and quickly convert them into tax invoices.

How can I create a Proforma Invoice online for free?

You can use a prebuilt format in Google Sheets to quickly create a performa Invoice online free. You can also use invoicing Software like SleekBill to create free proforma Invoice online.

Rajan is pursuing CA with a keen interest in trends and technologies for taxation, payroll compliances, Tally Accounting, and financial nuances. He is an expert in FinTech solutions and loves writing about the vast scope of this field and how it can transform the way individuals and businesses... Read more