Invoicing plays a critical role in maintaining smooth business transactions between the seller and buyer by acting as a way of communicating the terms and conditions. Invoices are time-stamped documents that record each transaction between the buyer and seller. You can track payments, gather business insights for better strategies, and file taxes easily.

A business also establishes its financial credibility in the eyes of customers through invoices. It is essential to know the difference between different types of invoices for their accurate creation. This blog discusses the difference between two of the most used invoices, which are, proforma invoices and tax invoices.

What Is Proforma Invoice?

Proforma invoice is an estimated invoice or a preliminary bill that is shared with the prospective buyer, before the products or services are delivered to him or her. The purpose of pro forma invoice is to give an estimate of the closing price and seek approval from the buyer. Once the customer agrees to the details in the proforma invoice, you can send the products or services.

It can be used for the internal purchase approval process, declaring the value of import goods for customs, or a preliminary invoice with a quotation when details for a commercial invoice are not available. Its main benefits include streamlined sales processes and smoother delivery processes.

Suggested Read: How to Create Performa Invoice in TallyPrime?

Unlike an invoice, it is not a payment request or demand. Although it includes shipping charges and applicable taxes to ensure precise price estimates for buyers, it is subject to change. No one can use it for accounting tasks. It does not have an invoice number as the work is still in progress when it is sent and hence, you cannot use it for legal purposes.

You can create pro forma invoices in common applications like Microsoft Word and Google Docs. To speed up the creation process, you can go for accounting or invoicing software solutions that already have customizable proforma invoice templates.

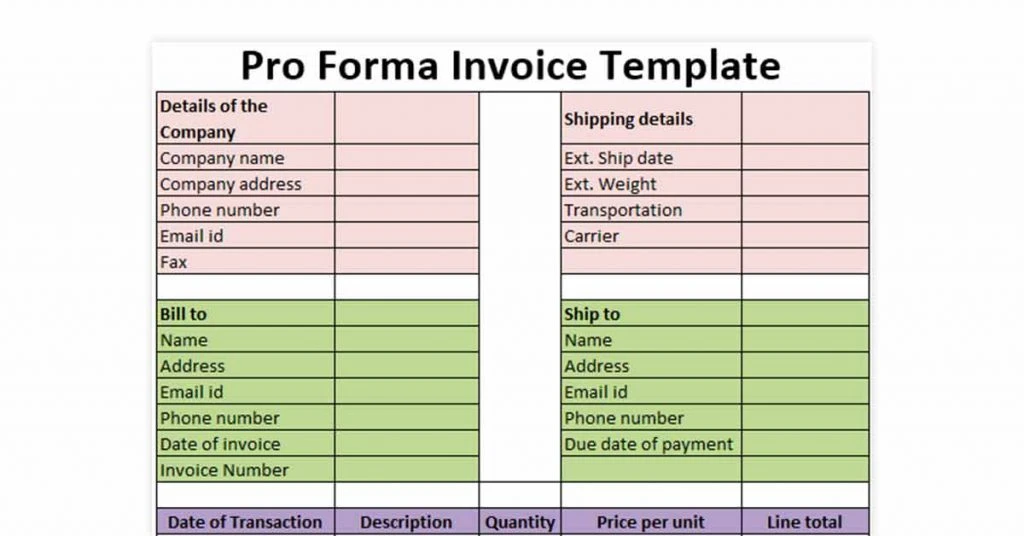

What’s Included in Proforma Invoice?

A proforma invoice must include a note stating, ‘This is not a GST invoice’. Other than that, it usually includes most parameters that are present in the final invoice. The following details of the proposed transaction are present on a standard basis:

- The term “proforma invoice”

- A unique invoice number

- Supplier company’s name, contact details, and address

- Prospective customer’s name and address

- Supplier’s banking details, including account number and IFSC code

- Preparation/issue date and due date

- Product descriptions; includes unit costs and line-item totals

- Proposed terms and conditions of sale

- Payment terms & proforma invoice validity

- Signature by company’s authorized signatory

- GST registration number, HSN/ SAC codes related information, SGST/ IGST/ CGST classification (for GST proforma invoice)

What Is Tax Invoice?

A tax invoice is a legal document that is sent to the customer by the supplier as a request for tax inclusive payment for the sale of goods and services. It includes the quantity, prices, discounts, credits, description, taxes, and total due on goods and services. The invoice acts as evidence of supply as goods are supplied at the invoice issue date or payment receipt date, whichever is earlier.

Every registered GST taxpayer is bound to issue tax invoices at the time of supply according to Section 31 of the CGST Act. The invoices are useful for financial reporting, monthly, quarterly, or annually. They are sent to the tax authority at the end of the financial year.

Suggested Read: Best Free Invoicing Software for Small Businesses

If the objective of buying is resale, customers can get an input tax credit on various charged taxes (GST, VAT, or HST). Tax-registered buyers need it to determine the time limit for the taxable supplies and make input tax deduction claims on purchases. In the case of unregistered suppliers, the customer needs to issue a tax invoice and payment voucher.

Like for a proforma invoice, invoice generation software tools offer customizable templates for tax invoices in different industry/ business categories. The tax calculation by the accounting software is dependent on the date of the tax invoice. Such tools improve the efficiency of invoice creation and reduce manual work.

What’s Included in Tax Invoice?

A tax invoice often includes the following:

- The term “Tax Invoice”

- Tax invoice number

- GSTIN of supplier and buyer

- Name of supplier’s company, address, and contact details

- Name of customer, address, and contact details

- Invoice issue date

- Description & quantity of services/ goods sold

- Tax rate, tax amount, and HSN/SAC code

- Price per unit, discount given, the total amount

- Signature of authorized signatory

Suggested Read: Best Sites to Download Free Invoice Templates

Proforma Invoice Vs Tax Invoice: Comparison Table

Here’s a quick summary of Proforma vs tax invoice:

| Parameter | Proforma invoice | Tax invoice |

| Definition | Preliminary bill of sale stating precise price estimates for buyers | Final bill of sale showing tax payable |

| Purpose | Token of agreement for transaction between buyer and seller | Request for tax credit |

| Type | Quotation | Bill |

| Timing | When the customer sends an enquiry, and the project is not yet complete | During or after completion of a transaction |

| Legal Requirements | No legal binding, not mandated by law | Mandated for registered taxpayers and acts as evidence of goods supply |

| On Acceptance | Confirmation of sale | Creation of sale |

| Enforceability | No, it can’t be used for accounting purposes | Yes, used in tax calculations |

| Terms of Invoice | Negotiable, Subject to change | Non-negotiable/ Final |

Tax Invoice vs Proforma Invoice: Key Differences

While both of these invoices are used in business transactions, there are significant differences when you discuss tax invoice vs proforma invoice. Some of the major ones are:

Goal: A tax invoice serves as evidence of goods/ services’ supply and can be used by the buyer to claim tax credit. A proforma invoice, on the other hand, simply serves as a form of transaction agreement between the buyer and the seller.

Revisability: A tax invoice contains the final transaction details like taxable amount and total payment due that cannot be changed. The terms of payment and other details stated in the proforma invoice can be negotiated by the buyer and revised any number of times till they come to an agreement.

Accounting: Tax invoice is used for accounting purposes and recorded under accounts payable for the client and accounts receivable for the seller/ supplier. A proforma invoice is just a proposed estimate and the data cannot be used for accounting.

Legal binding: Tax invoice is legally binding and mandated for registered taxpayers under the Section 31 of CGST Act, 2017 in India. Proforma invoice does not serve as an obligation on either the buyer or seller. It cannot be used as proof of sale in court or for claiming tax deductions.

Suggested Read: How Automated Invoice Processing Works for Quick Payments?

Conclusion

Now that you have understood proforma vs tax invoice in detail, you can start creating invoices. Make sure that you include all the necessary components whether you start creating from scratch or using a customizable template.

FAQs

Can you use proforma invoice as a tax invoice?

No, proforma invoice only provides a price estimate. So, you must create a separate tax invoice after transaction for GST/ income tax purposes if you are a registered taxpayer.

Should proforma invoice include tax?

Proforma includes all details of the proposed sale, including tax estimates when a customer enquires about a product or a service. However, the actual tax is only included in the invoice when the customer sends confirmation.

Is proforma invoice allowed in GST?

Yes, proforma invoices are allowed under the GST law with the addition of GST registration number, GST Classification into CGST, IGST, and SGST, and information regarding SAC codes of services or HSN codes of goods. However, you need a tax invoice for GST calculations.

What is proforma invoice and tax invoice?

Proforma invoice is a document issued by the supplier to a potential buyer that contains the estimated price of the enquired products or services along with other terms and conditions. Tax invoice is a commercial document issued by the supplier to notify the recipient of goods and services about the tax amount in closing price.

Is proforma invoice a legal document?

No. While proforma invoice does carry most of the details as on the final invoice, it is only an estimate and cannot be used for accounting or as a legal document.

What is proforma tax invoice format?

Proforma tax invoice format is the way the invoice must be designed and the standard fields that must be included. It varies according to payment methods, tracking method, and frequency of charging. It includes tax identification number (GSTIN) and the amount of applicable taxes, among other proforma content details.

What is proforma invoice for advance payment?

A supplier may accept advance payment from the recipient of products/ services based on the proforma invoice, although it is not an obligation. Balance amount is paid as per terms of the payment agreement when the final invoice is issued.

What is the difference between proforma invoices and tax invoices in India?

Proforma invoice is a non-legal, revisable document for a prospective buyer to agree to the estimated cost and terms of payment before the transaction stage. Whereas tax invoice is a document that is legally binding and non-negotiable when issued to the buyer. Tax invoice is a type of GST invoice in India.

Related Categories: Billing And Invoicing Software | Restaurant Billing Software | POS Software

Ayushee is currently pursuing MBA Business Analytics from SCMHRD, Pune with a strong background in Electronics and Communication Engineering from IGDTUW. She has 2 plus years of full-time work experience as an SEO content writer and a Technology Journalist with a keen interest the amalgamation of business and... Read more