Maintaining financial records accurately is crucial to running a successful business. Manual accounting processes are time consuming, prone to errors, and do not provide enough visibility to make smart decisions.

So, businesses use accounting software to record and report their financial transactions with much more accuracy and security. The reports generated by accounting software can provide insights for tax computations, invoicing and billing, auditing, expense management, and more.

Tally ERP 9 is one such accounting software that is popular in India for running businesses smoothly. It can simplify cash flow management, taxation and GST filing, among others. Moreover, it is customizable and has functionalities like finance, sales, inventory, accounting, purchase, etc.

What are Ledgers in Tally ERP 9 or TallyPrime?

Ledger in Tally ERP 9 is a group of accounts, which is essential to record and identify financial transactions of a business unit. Ledgers in Tally are used along with accounting vouchers.

In ledgers, daily transaction entries in journals are categorized based on their nature. As a result, you can understand the status of assets and liabilities, accounts payable and receivable during the accounting period.

Examples of ledger account include sales, purchases, receipts, and so on. They help in making a trial balance worksheet for account accuracy and provide essential data for preparing balance sheets, profit and loss (P/L) statements, and more.

Suggested Read: Types of Voucher in Tally ERP 9 to Manage Transactions | Best Tally Alternatives

Types of Ledgers in Tally ERP 9: Complete Tally Ledger List

There are several types of ledgers that you can generate in Tally Prime. Let’s check the tally ledger list:

- Purchase/Sales Ledger in Tally

Sales ledger records credit sales and sources documents like debit notes and sales invoices. Purchase ledger can record purchase transactions. Both these ledgers are essential during trading, repacking or manufacturing products. They come under the revenue account category and are used in the profit and loss (P/L) account.

- Income and Expense Ledger

All those ledger accounts that record the amount earned or receivable against goods and services in a financial year are covered under the income ledger. For booking expenses, an expense ledger can be created.

These ledgers can be categorized under direct income, indirect income, direct expense, and indirect expense groups. Therefore, these records can be considered in the assessable value of excise if needed.

- Party Ledger

Party ledgers include transactions involving supplies, receipts, payments, and more. Parties include customers, wholesalers, retailers, among others. Details included in the party ledger are account Name, closing balance, credited/ debited amount, etc.

- Tax Ledger

Tax Ledgers come under the Duties and Taxes group and contain different tax accounts such as sales, VAT, Excise, among other trade taxes and total liability. GST also comes under this ledger type in Tally.

- Bank Account

Bank ledgers contain data about the bank affiliated with your business for making or receiving payments. This data includes Bank name, Account no., IFS code, and address.

So, if you choose banks like YES BANK, Standard Chartered Bank- India/ UAE, ICICI Bank, Kotak Mahindra Bank, HDFC Bank, Bank of Baroda, and DBS Bank, you can go with e-payment mode too.

- Current Liabilities and Assets

Current Asset/ Fixed asset ledger includes the entire amount that a business needs to pay in the form of money or goods in the future.

Suggested Read: Different Types of Accounting Software For Financial Management

Types of Ledger Group in Tally: Tally Ledger Under Group List

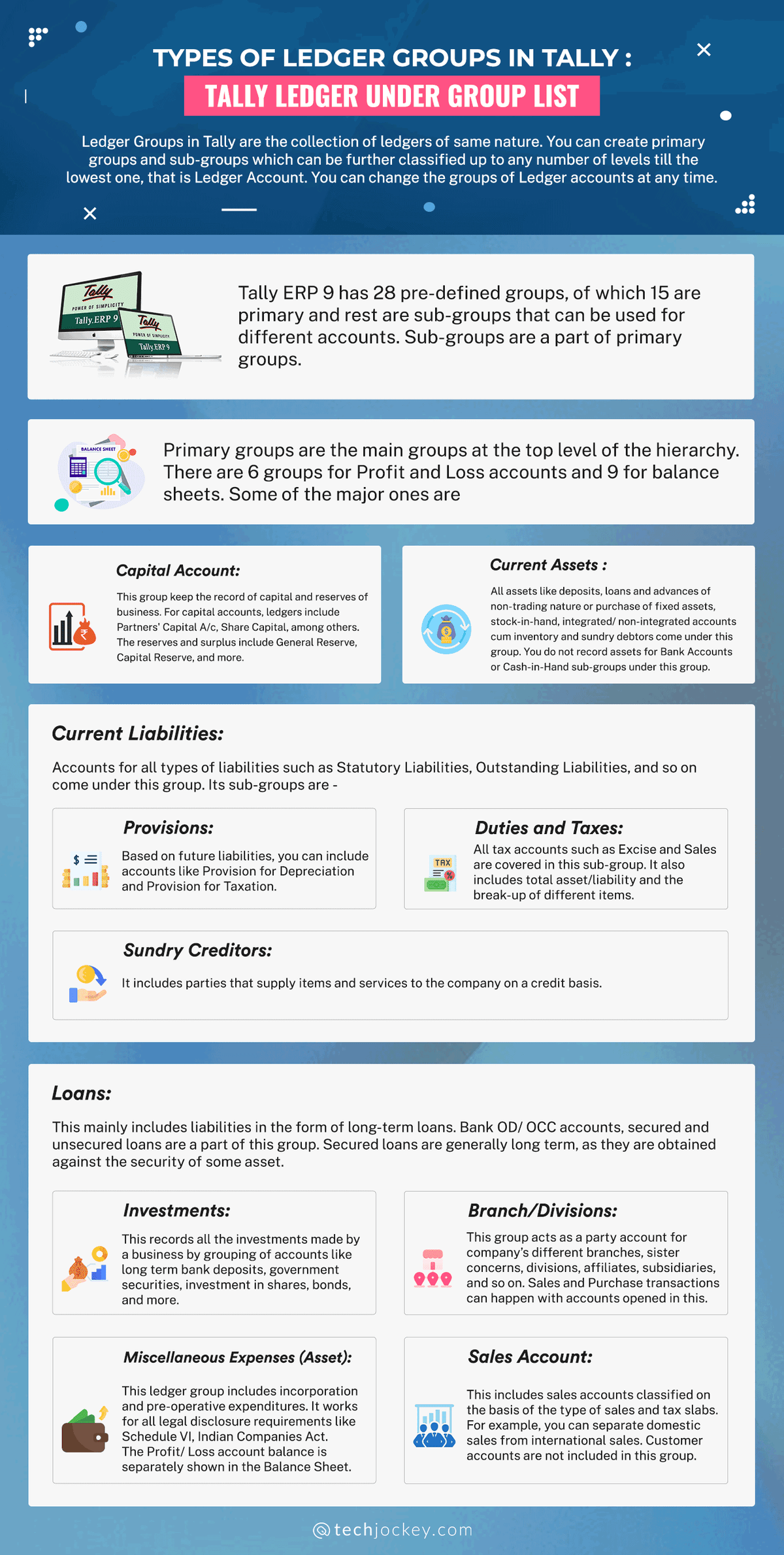

Ledger Groups in Tally are the collection of ledgers of the same nature. You can create primary groups and sub-groups that can be further classified up to any number of levels until the lowest one, the Ledger Account. You can change the groups of Ledger accounts at any time.

Tally ERP 9 has 28 pre-defined groups, of which 15 are primary, and the rest are sub-groups that can be used for different accounts. Sub-groups are a part of primary groups.

Primary groups are the main groups at the top level of the hierarchy. There are 6 groups for Profit and Loss accounts and 9 for balance sheets. Some of the major ones are:

- Capital Account

This group keep the record of capital and reserves of a business. For capital accounts, ledgers include Partners’ Capital A/c, Share Capital, among others. The reserves and surplus include General Reserve, Capital Reserve, and more.

- Current Assets

All assets like deposits, loans and advances of non-trading nature or purchase of fixed assets, stock-in-hand, integrated/ non-integrated accounts cum inventory and sundry debtors come under this group. You do not record assets for Bank Accounts or Cash-in-Hand sub-groups under this group.

- Current Liabilities

Accounts for all types of liabilities such as Statutory Liabilities, Outstanding Liabilities, and so on come under this group. Its sub-groups are:

- Provisions: You can include accounts like Provision for Depreciation and Provision for Taxation based on future liabilities.

- Duties and Taxes: All tax accounts such as Excise and Sales are covered in this sub-group. It also includes total assets/liability and the break-up of different items.

- Sundry Creditors: It includes parties that supply items and services to the company on a credit basis.

Suggested Read: What is Accounting: Types, Benefits and Best Practices

- Loans

This mainly includes liabilities in the form of long-term loans. Bank OD/ OCC accounts, secured and unsecured loans are a part of this group. Secured loans are generally long term, as they are obtained against the security of some asset.

- Investments

This records all the investments made by a business by grouping accounts like long term bank deposits, government securities, investment in shares, bonds, and more.

- Branch/Divisions

This group acts as a party account for different branches, sister concerns, divisions, affiliates, subsidiaries, etc. Sales and Purchase transactions can happen with accounts opened in this.

- Miscellaneous Expenses (Asset)

This ledger group includes incorporation and pre-operative expenditures. It works for all legal disclosure requirements like Schedule VI, Indian Companies Act. The Profit/ Loss account balance is separately shown in the Balance Sheet.

- Sales Account

This includes sales accounts classified based on the type of sales and tax slabs. For example, you can separate domestic sales from international sales. Customer accounts are not included in this group.

Other primary groups include Purchase Account, Suspense Account, Fixed assets, Direct and Indirect Income, Direct and Indirect Expenses.

Suggested Read: 13 Best Free and Open Source Accounting Software

Single Ledger Creation in Tally ERP 9

Tally 9 has two pre-defined ledgers that are automatically created. These are the Profit and Loss account and Cash account. In addition, you can create more cash accounts and other ledger accounts based on the company’s requirements.

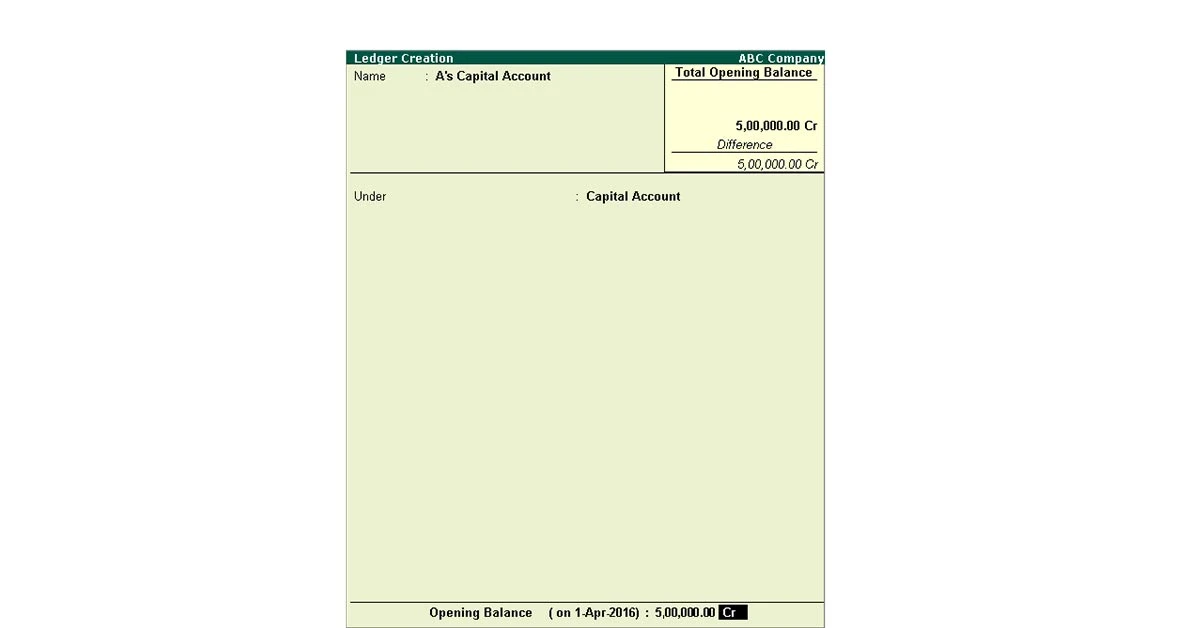

For creating a single ledger in Tally ERP 9, users must follow the following steps:

Step 1: First, go to Gateway of Tally.

Step 2: Under Gateway of Tally on the screen, select Accounts Info.

Step 3: Next, choose Ledgers option

Step 4: In Single Ledger sub-option, choose to Create.

Step 5: A Ledger Creation screen gets displayed. Now, enter the ledger account’s name. The name cannot be duplicated and must be unique. You can also enter the alias of the account if needed. Both name and alias name can be used to access the ledgers.

Step 6: In List of Groups, select the group name or category based on the type of ledger account you wish to create. In case you want a new group from this field, use the shortcut command Alt + C on your keyboard. The group can be changed anytime you want to alter the ledger account.

Enter the value of the opening balance if the ledger is a liability or an asset. It should be entered as the same account balance as that at the time of the beginning of books. If it is not a new company, you must enter credit balances for liabilities and debit balances for assets.

Finally, select the “Yes” option under Accept for saving the configured details.

Suggested Read: BRS in Tally: How to Perform Bank Reconciliation in Tally

Multiple Ledger Creation in Tally ERP 9

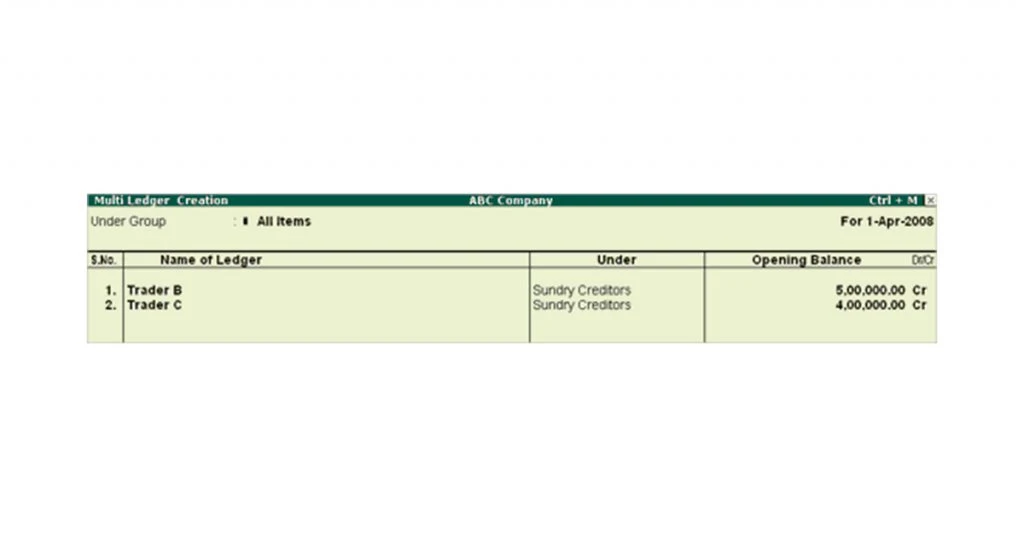

You can create multiple ledgers at once if you want to save time. In multiple modes, the ‘Inventory values are affected’ field is automatically selected as ‘Yes’ for Sales and Purchase Accounts and No for the rest.

The ‘Cost Centres are applicable’ field is selected as Yes by default for Revenue accounts. For remaining accounts, it is set as ‘No’. To create several ledgers, follow these steps:

Step 1: First, go to Gateway of Tally and select the Accounts Info option.

Step 2: Choose Ledgers under the Accounts Info option.

Step 3: Select Multiple Ledgers and then Create option.

Step 4: A multi ledger creation (10) screen appears. Choose All Items or the required group in which you want to form the ledger. In case you choose All Items, select the group for every ledger in the Under column. You can search a group in the group text field with the help of the group name.

Step 5: Enter the Name of the Ledgers you want to create.

Step 6: Next, enter the value of Opening Balance. For maintaining bill-by-bill balances, you have to provide bill details.

In the field, Dr/Cr enter whether the opening balance is debit or credit.

Finally, save the Multi Ledger Creation screen.

Suggested Read: Depreciation Entry in Tally Prime and ERP 9 (with Examples) 2023

What are the Shortcut Key to Create Ledger in Tally?

Shortcut keys are one of the most popular features in Tally for fast data entry and higher efficiency. Some of the most popular shortcuts are:

| Shortcut Key | Description | Location |

|---|---|---|

| Alt + C | To form a ledger | First, go to gateway of Tally, then select Accounts Info. and Ledgers from the options. Finally, select Create. |

| Ctrl + Enter | To modify a ledger | Move to gateway of Tally and choose Accounts Info. Choose Ledgers from the option and click Alter |

| Alt + R | To cover up a ledger | Available on many Tally screens |

| Alt + U | To reveal hidden ledger | Available on many Tally screens |

| F1 | #To choose/ pick the company #For choosing the Accounts Button | #On going to Gateway of Tally (masters menu screen) #Present at the creation and alteration screen for accounting voucher |

| ALT+F1 | Inventory selection | At the creation/ alteration screen for Inventory/Payroll Voucher |

| CTRL + F1 | Choosing Payroll voucher | From Gateway of Tally, choose Inventory Voucher/Accounting Voucher and then select Payroll Voucher (creation or alteration screen of Accounting/Inventory voucher) |

| F2 | For alteration of current date | Most of the Tally screens |

| CTRL + F2 | Selection of Sales Order Voucher | Under Gateway of Tally, choose Accounting Voucher/ Inventory Voucher and next, Sales Voucher (Screen for Accounting Voucher/ Inventory Voucher) |

| Alt+F3 | Moving to company info | A part of multiple Tally screens |

| F4 | Opening a Contra voucher | Select Contra Voucher from Accounting Voucher present in Gateway of Tally options (Creation and alteration screen for Accounting or Inventory Voucher) |

| Alt+F4 | For unlinking the organization from Tally.Net server | Tally’s screen showing Company info |

| CTRL + F4 | Selection of Purchase Order Voucher | From Gateway of Tally, move to Accounting Voucher / Inventory Voucher and then Purchase Order Voucher (from Accounting Voucher Screen) |

| F5 | Choosing Payments Voucher | Under Gateway of Tally, go to Accounting Voucher and choose Payments Voucher (At the creation and alteration screen of Accounting / Inventory Voucher) |

| F6 | Choosing Receipt voucher | Select Gateway of Tally and then Accounting Voucher. Next, choose Receipts Voucher (At screen for Accounting / Inventory Voucher’s creation and alteration) |

| F7 | Opening Journal voucher | Move to Gateway of Tally and then Accounting Voucher. Next, choose Journal Voucher (Creation and alteration screen of Inventory/ Accounting Voucher) |

| F8 | Selection of Sales Voucher | From Gateway of Tally, move to Accounting Voucher. Next, go to Sales Voucher (Creation and alteration screen for Accounting/ Inventory Voucher) |

| CTRL + F8 | For opening Credit Note voucher | Under Gateway of Tally, click Accounting Voucher and then Credit Note (At creation and alteration screen for Accounting / Inventory Voucher) |

| F9 | Opening of Purchase voucher | Move to Purchase Voucher in Accounting Voucher sub-option under Gateway of Tally (Voucher creation and alteration screen in Accounting/ Inventory) |

| CTRL+F9 | For opening a Debit Note voucher | In Gateway of Tally sub-options, choose Accounting Voucher and then Debit Note (At the Voucher’s creation and alteration screen in Accounting / Inventory) |

| F10 | For selection of Reversing Journal voucher | At creation/ alteration screen for Accounting / Inventory Voucher |

| CTRL + F10 | Selection of memorandum voucher | Under Gateway of Tally, choose Accounting Voucher / Inventory Voucher and then Memorandum Voucher (At creation and alteration screen of Accounting / Inventory / Payroll Voucher) |

| F11 | Opening Company Functions screen | A part of a lot of Tally screens |

| F12 | Opening the configuration screen | A part of a lot of Tally screens |

| ALT + A | For Addition of a voucher | Where the List of Vouchers is present. This shortcut key adds a voucher after the one where you positioned the cursor and used this key combination |

| CTRL + A | In order to accept a form | Available on multiple Tally ERP 9 or TallyPrime screens, except where a specific detail needs to be provided before accepting |

| CTRL + B | Budget selection | At Groups, Budgets, Ledgers, Cost Centers, Scenarios, Currencies, Voucher Types (Accounts Info) creation and alteration screen |

| ALT+ V | For bringing Stock Journal screen from Invoice Screen | Move to Invoice screen and then Quantity Field. Then, press Alt + V for selecting the Stock Journal |

| CTRL + V | Selection of the Voucher Types | At the creation screen for Sales/Purchase Voucher |

Suggested Read: Tally Introduction, Features & Specifications | How to Make Debit Note and Credit Note Entry in TallyPrime

FAQs

How to delete ledger in Tally ERP 9?

For a ledger with no vouchers in Tally ERP 9, go to Gateway of Tally > Accounts Info. > Ledgers > Alter > Press Alt + D. If vouchers have been created under the ledger, delete the vouchers and then follow these steps to delete the ledger in Tally.

How to delete multiple ledgers in Tally ERP 9?

To delete multiple ledgers in TallyPrime, go to Gateway of Tally > Display > List of Accounts > F5: Show Unused. Select the ledgers to be deleted from the list of unused ledgers. Press Alt+D after selection. Click Enter.

How to alter ledger in Tally?

You can change single ledgers and most fields in multiple ledgers. You cannot alter the closing balance under the group stock-in-hand in Tally. For altering a ledger, go to Gateway of Tally > Accounts Info. > Ledgers > Alter.

How to create same name ledger in Tally ERP 9?

You can add a minor difference to names. For example, party name ledgers can be separated by regions like State or city names.

Instead of creating ledgers for each location with the same name, users can create a single ledger with multiple addresses. Go to Gateway of Tally > Accounts Info > Ledgers > Create.

On the Ledger Creation screen, click F12: Configure. On the Master Configuration screen, set the option ‘Use MULTIPLE Addresses’ to Yes. Press Enter. Now specify different addresses and other details.

Press Enter to proceed. Press Ctrl + A to save the ledger. These addresses can now be selected during transaction entry.What are Tally ledgers and groups?

Tally ledgers are account heads such as sales, payment, purchase, receipts and more to recognize all transactions. They are used in accounting vouchers for entries. Groups are the collection of ledgers of the same natures. There are 28 pre-defined groups in Tally for different ledger types.

What is included in the list of groups in Tally?

There are 15 primary groups in Tally. They are Branch/Division, Current Assets, Indirect Income, Capital Accounts, Fixed Assets, Misc. Expenses, Loans, Investments, Purchase Accounts, Suspense Account, Sales Accounts, Direct Income, Current Liabilities, Indirect Expenses, and Direct Expenses.

There are 13 subgroups in Tally. These include Sundry Creditors, Secured Loans, Bank Accounts, Stock in Hand, Deposits, Cash in Hand, Duties & Taxes, Banks OD Accounts, Loan & Advances (Assets), Unsecured Loans, Provisions, Reserves & Surplus, Sundry Debtors.Salary payable under which head in Tally?

Any type of payable, including salary payable, comes under Provisions. Provisions are set aside from profits to handle upcoming liabilities.

Bank charges under which head in Tally?

Bank charges are a part of Indirect Expenses or Expense (Indirect) head in Tally.

Depreciation under which head in Tally?

You put depreciation under Indirect Expenses or Expense (Indirect) head in Tally. Fixed assets on which depreciation is charged come under Fixed Assets head.

GST payable under which head in Tally?

GST payable comes under Duties and Taxes head in Tally.

Professional fees under which head in Tally?

You put Professional fees under Indirect Expenses or Expenses (Indirect) in Tally.

Fixed deposit under which head in Tally?

You put a fixed deposit under the Bank account in Tally.

Insurance under which head in Tally?

Life insurance comes under Capital A/c, insurance premium under Indirect Expenses or Expense (Indirect) and prepaid insurance charges under Current Assets head.

Credit card under which head in Tally?

For credit cards, the cash credit limit comes under Bank OCC.

Related Categories: GST Software | Expense Management Software | Income Tax Software | Debt Collection Software

Ayushee is currently pursuing MBA Business Analytics from SCMHRD, Pune with a strong background in Electronics and Communication Engineering from IGDTUW. She has 2 plus years of full-time work experience as an SEO content writer and a Technology Journalist with a keen interest the amalgamation of business and... Read more