The best payroll tax calculators in India are useful for the accounts team to get payroll tax figures for different employees and file the payroll tax on their behalf. Several online payroll calculator tools also provide HR services such as onboarding and time tracking through time sheets.

Before we tell you more about the functioning of a payroll calculator tool, let’s discuss what payroll tax is and its significance for payroll calculations in India.

Payslip Calculator India: Understanding Payroll Tax in India for Employers

Payroll tax is the tax that an employer deducts from an employee’s pay package and pays it to the government. Payroll tax of an employee is calculated by using a payroll tax calculator software on the aggregate income, including allowances such as HRA, LTA, etc. of an employee during their association with a company.

In India, the rate of tax deduction is revealed each year in the annual budget made by the finance ministry, and thus is an important criteria for payroll calculations in India.

What Are the Rules for Calculating Payroll Taxes in India?

Payroll Calculations in India are bounded by the following rules:

- An employer must consider the annual income of an employee as well as their investment declarations while using a free paycheck calculator to figure out their payroll tax.

- For financial year 2020-21, you can know your tax liability in the following manner:

- For salaried, the net income is the sum of basic salary and allowances which include HRA, travel allowance etc. Some components of your allowances are exempted from taxes such as phone bills and leave travel allowance.

- As per old tax slab, you can obtain your taxable income after deducting exemptions available to you.

- As per the new tax slab, you can pay taxes on your income without excluding exemptions.

- While calculating income tax liability for the current financial year, you must declare your investments, rental income, EMIs paid for home loan, etc.

- The revised salary slabs to compute payroll tax for FY 2020-2021 are as follows:

| Income Slab (per annum) | Tax rate |

| 0-2,50,000 INR | No Tax |

| 2,50,001 – 5,00,000 INR | 5% |

| 5,00,001 – 7,50,000 INR | 10% |

| 7,50,001 – 10,00,000 INR | 15% |

| 10,00,001 – 12,50,000 INR | 20% |

| 12,50,001 – 15,00,000 INR | 25% |

| Above 15,00,000 INR | 30% |

Exemptions to Payroll Taxes for the FY 2020-21

While undertaking employee salary calculation, employers need to consider the different exemptions offered under India’s income tax rules.

- Allowances offered to employees such as house rent allowance, travel allowance, etc. can be exempted upon submitting appropriate proofs.

- Employees can obtain tax relief on investments made in government schemes, mutual funds, etc. They can also seek deduction on home loan EMIs, fees paid for child’s education and premium paid for insurance schemes.

- Employees can further seek tax benefits by declaring losses in the financial year to their employers. These include losses occurred in lieu of their movable and immovable assets.

10 Best Online Payroll Calculators in India (Employer Taxes Calculators)

Now that you know all about payroll taxes, we list the best employer payroll calculators known for correct and transparent computation of taxes each employee is liable to pay.

SumoPayroll Online Payroll Calculator

SumoPayroll is a cloud-based payroll calculator that also manages HR services and timesheets. Through this employer taxes calculator, employees can easily view their payslips, statutory forms, settlements etc. For employers, the platform ensures an easy update of new employee details, tax records, payroll history, etc.

Features

- Customized Mobile App

SumoPayroll mobile app can be customized as per an organization’s needs.

- Payroll notification

Employees get automatically notified when payroll gets processed. They can access their payslips on any device.

- Easy filing of salary information

Employers can quickly fill up salary information for different employees including their bonuses, commissions, overtime, etc.

- Timesheet

SumoPayroll tracks employee attendance on the basis of timesheets. Employers can use timesheets to generate monthly time reports.

- Tracking expenses

Expenses can be sorted as per incurred date, type, etc. This income tax calculation software also supports the uploading of receipts corresponding to these expenses.

SumoPayroll Employer Salary Calculation Software Pricing:

SumoPayroll software price starts from ₹39 per user per month. For demo and detailed price, visit Techjockey.com

Onpay Paycheck Tax Calculator

Onpay payroll calculator is one of the best employer taxes calculators for small businesses to automate payroll tax filing for employees. With Onpay payroll tax calculator software, you can also obtain support from payroll professionals in case of grievance.

This hourly payroll calculator also ensures the free setup and migration of employee tax information from your existing salary payroll calculator.

Onpay Features

- Robust HR tools

Onpay online payroll calculator offers HR tools for the self-onboarding of employees.

- COVID 19 specific dashboard

COVID 19 dedicated dashboard of Onpay lets you run payroll remotely and access payroll tax credit history.

- Multiple modes of payment

Employers can pay salary through different modes such as direct bank deposits, debit cards or checks.

- Payroll generation through mobile

Employees can process payroll anywhere from their mobile phones.

- Integration with payroll and time tracking software

Onpay offers integration with payroll apps such as QuickBooks and Xero and attendance tracking apps such as Deputy and TSheets.

Onpay Payroll Calculator Pricing: Onpay offers the first month free. After that the price of software starts from ₹2971.80 per user per month.

With the paid version of Onpay payroll calculator, the user gets features such as automatic filing of payroll taxes and accounting and time tracking integrations.

Gusto Salary Slip Calculator Online

Gusto payroll tax calculator software is an online salary payroll calculator suitable for small businesses for filing payroll taxes for employees with automatic syncing of time tracking and benefit plans.

Gusto also provides the feature of Autopilot, through which payroll can be generated quickly for all your employees.

Features of Gusto

- Integrations with accounting and time tracking software

Gusto offers enhanced integrations with time tracking software such as TSheets and accounting software such as Clover.

- Auto calculation of payroll tax

Gusto automatically calculates payroll tax of each employee as per current tax laws. It keeps updating its system as and when tax laws change.

- Efficient tracking of employees

Companies can keep an efficient tracking of an employee productivity with this online payroll calculator. This is helpful if the employees are paid by the hour.

- Account set-up by employees

Employees can set up accounts on their own. An employee’s details such as their payslips are stored by the paycheck tax calculator even when they have left the organisation.

- Unlimited payroll with flexible schedules

With Gusto, you can run payroll as many times as you need. You can also change payroll schedules to pay different teams at different times.

Gusto Paycheck Tax Calculator Pricing: Price of this payroll tax calculator software starts from ₹2896.35 per user per month.

iCalculator Payroll Calculator

iCalculator free paycheck calculator is a specialized tax and salary tax calculating tool that can be used by companies and individuals residing in different countries. You can select the country of residence and iCalculator will show applicable taxes for employers.

iCalculator Features

- One for all tax calculator

iCalculator is suitable for use by individuals, small and medium enterprises and families planning their budget.

- Annual update

The software’s algorithm is updated annually to work according to the latest tax rules in different countries.

- Finance tools

iCalculator finance portal contains financial guides, information and free calculators for pension, mortgage etc.

- Multi device compatibility

iCalculator can be used across different devices such as mobile, tablet and desktop.

- Human resource calculator

This payroll calculator can also be used for calculating human resource indices such as revenue per employee and true cost per employee.

iCalculator Salary Slip Calculator Online Price: iCalculator tool for payroll calculations in India is a free paycheck calculator.

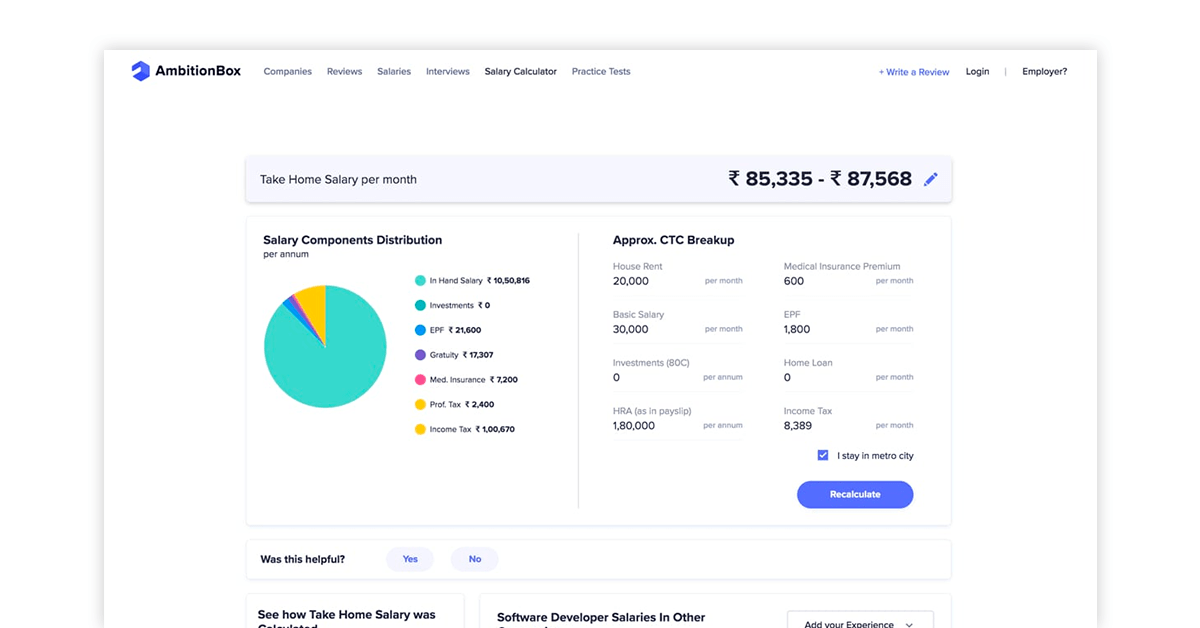

AmbitionBox Employer Taxes Calculator

AmbitionBox salary calculator is a free paycheck calculator that tells you exactly how much tax you have to pay for your salary bracket. All you have to do is input your designation, company name, CTC, experience and tax regime and the payroll calculator will automatically work up the in-hand salary of an employee.

AmbitionBox Features

- Multi device compatibility

Features of this software can be accessed from mobile, desktop and tablet.

- Calculation of payroll as per different tax rates

AmbitionBox salary calculator allows you to calculate taxes based on the new and old income tax slab. The old tax slab has higher rates but more exemption. The new tax slab charges lower rates but has less exemptions.

- Salary comparison

You can compare salaries offered for the same position across different companies.

- Expense details based on workplace location

AmbitionBox salary calculator considers whether you work in a metro city or not and then accordingly shows you expenses. People working in metro cities will usually have extra expenses.

- Easy to use software

The payroll tax calculator has an intuitive interface. Even first-time users can know their tax information in a few steps.

AmbitionBox Employee Salary Calculation Tool Pricing: This payroll calculator can be used free of cost.

Paycheck Manager Employer Taxes Calculator

Paycheck manager is a popular salary payroll calculator that provides employees a self serving portal for viewing and printing their payroll reports. The free paycheck calculator is suitable for small businesses that employ a limited number of people.

Paycheck Payslip Calculator India Features:

- Instant processing of paycheck

You can process paycheck instantly for contractual workers and terminated employees.

- Inbuilt tax forms

The software for payroll calculations in India provides inbuilt tax forms for easy filing of taxes for different employees.

- Enhanced customer support

In case of any issues, you can obtain customer support through email, phone, fax, etc.

- Different pay rates for payroll processing

With Paycheck manager, you can process payroll as per hourly, daily, monthly and annual pay rates.

- User friendly

The software can be easily used even by first timers and it saves no private info of your company or employees.

PaycheckEmployer Payroll Tax Calculator Pricing: Paymaster payroll tax calculator software can be used free of cost for first three months. After that, you can buy its paid plan starting from ₹369.54 per month.

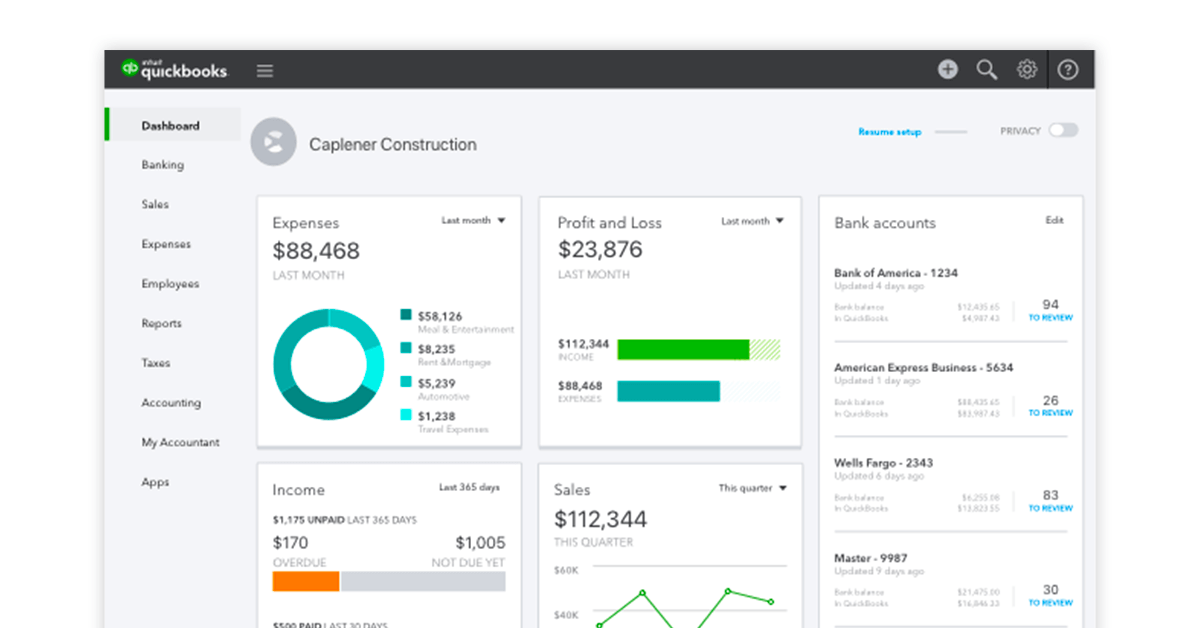

QuickBooks Online Payroll Calculator

QuickBooks paycheck calculator is a GST accounting software especially designed for small businesses. This cloud based paycheck tax calculator can also be used to generate error free invoices. You can sync your phone gallery with QuickBooks paycheck calculator and upload receipts of your expenses.

QuickBooks Payroll Calculator India Features

- Intuitive dashboard

You can track sales, view your expenses and manage invoices through the software’s intuitive dashboard.

- Multi device compatibility

You can access this software from different devices such as mobile, tablet and desktop.

- Time tracking of employees

Track how much time an employee works for and calculate their billable hours. You can then add these expenses to invoices.

- Managing bill payment

You can set reminders for bill payments and even schedule recurring payments.

- Accounting reports

Access customizable reports to see how your business’s performance metrics.

QuickBooks Paycheck Tax Calculator Pricing: QuickBooks paycheck calculator offers a 30-day free trial. After that you can subscribe to the paid plan starting from ₹223 per month. It offers features such as document exchange and dedicated training and support.

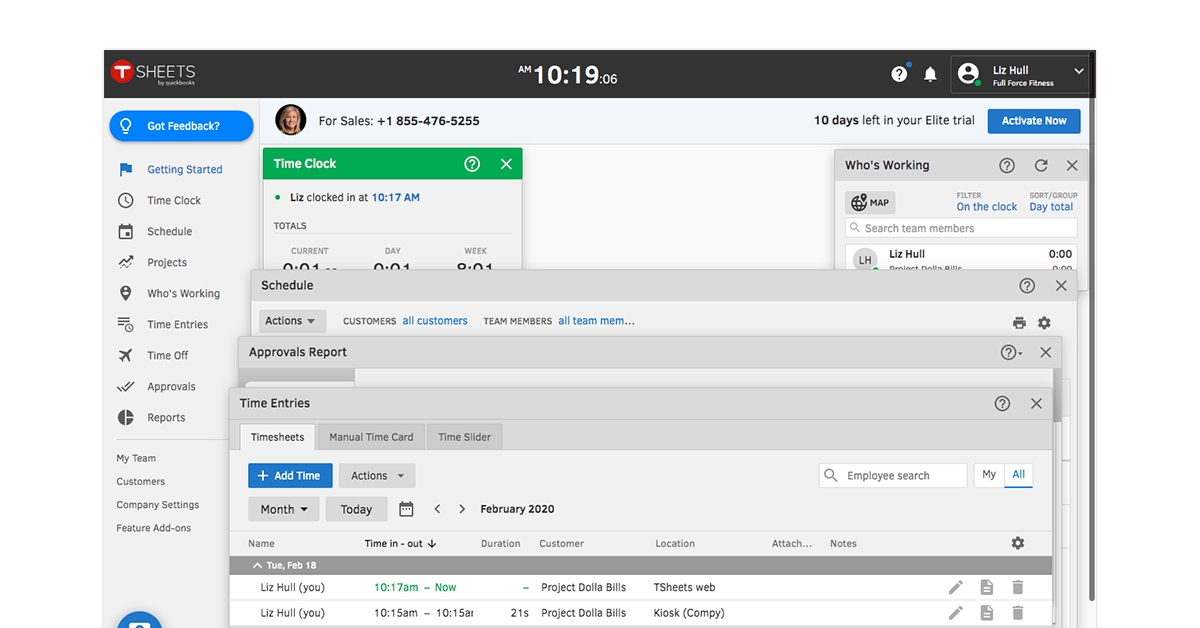

TSheets

In addition to tracking time of your employees, this tool for doing payroll calculations in India is also suitable for employee labour cost. This automated payroll tax calculator syncs the process of time tracking and payroll generation to ensure that each employee is rightfully paid for the duration they have worked.

Features of TSheets Payslip Calculator India

- Multi Device compatibility

TSheets can be accessed from mobile, desktop or from the web.

- Easy tracking of time off and accruals

You can view accrued rates for each individual employee at any time.

- Quick Calculation

TSheets calculates an employee’s paycheck after taking into consideration relevant payroll taxes.

- Easy resolution of payroll disputes

In case of a payroll dispute, you can utilize the feature of internal audit log to track changes made to timesheets.

- Overtime notifications

Employees and managers get notification when they approach overtime hours, so that they can record these in their timesheets for correct payroll calculation.

TSheets Payroll Calculator India Pricing: TSheets offers a free trial period of 14 days. The complete version of the payroll tax calculator software can be purchased for a starting price of ₹586.94 per user per month with ₹2932 as base fee.

Patriot

Patriot online payroll software eases the payroll calculation process by adding working hours with applicable payroll taxes. With this salary calculator, you don’t have to worry about filling your taxes on time. The paycheck calculator remits payroll taxes before the deadline. You can also add new employees to the company’s payroll in quick steps.

Patriot Payslip Calculator India Features

- Works on Multiple locations

If your employees are present in different locations, the software can easily calculate their payroll tax specific to that location.

- Multiple device support

The payroll calculator can be used from smartphones and tablets.

- Differentiated pay rates

You can add up to 5 different pay rates for different employees and even add a short description to it.

- Add contractors to your payroll

With this payroll tax calculator software, you can pay third party contractors at the same time you pay your employees.

- Printing Pay checks

The software makes it easier for printing pay checks and pay stubs.

Patriot Payroll Calculator India Pricing: The software for payroll calculations in India offers a 30-day free trial. The complete version can be purchased for a price starting from ₹733.67 per month plus ₹293.47 for each employee or contractor.

PaycheckCity

This payroll calculator is meant for small and medium enterprises for calculating salary and bonuses of employees. The software currently provides 9 different calculators which include hourly calculators for employees paid by the hour and gross-up calculator. You can also use the software for calculating different types of taxes such as local, state, etc.

Features of PaycheckCity Payroll Tax Calculator Software

- Payroll resources

The software contains ample resources dealing with forms and tax research to help small businesses.

- Hassle free setup

You can quickly setup the software by entering details about employees and your office address

- Printed paychecks

The software provides you with printed paychecks and pay stubs.

- Regular tax report

This salary calculator generates annual and quarterly tax reports.

- Tax notification services

Any time there is a change in payroll taxes, you will receive immediate notifications. Attached also is an easy-to-access database for checking such changes. PaycheckCity Payroll Calculator Pricing: The software offers a 7-day trial period. The complete version can be obtained by paying around ₹14600.03 per year.

Best Payroll Tax Calculators in India: Summing it Up

Payroll tax calculators are important tools for an organization to compute and file payroll tax on the behalf of each employee. An employer taxes calculator software that is suitable for your business depends on your employee strength and other factors.

If you run a small or medium enterprise, then you can opt for a salary payroll calculator that also offers HR and time tracking services. This payroll tax calculator software will help in tracking the attendance, salary.

Most importantly, the employer payroll tax calculator you choose should have the latest tax rates of FY 2020-21 and should automatically update itself whenever tax laws change.

Mayank Dixit is a talented content writer with an enriching educational background with Bachelor's degree in Engineering and a Master's degree in Mass Communication. With this combination of technical and creative skills, Mayank is well-equipped to produce engaging content that is informative too. He is passionate about business... Read more