16 Best Free Income Tax Software for Tax eFiling, IT and TDS Returns

Summary: Businesses and individuals often face hassle in filing their income tax. This is where income tax software comes into play. It simplifies the process of tax preparation and filing. It helps with automatic tax calculations, error checks, and electronic filing options that ease down the task for CAs and tax professionals. Let’s delve deeper into it.

To complete income tax (IT) payments on earnings, an individual needs to file an IT return (ITR). The document acts as proof that the due income tax is paid.

Filing taxes and tax returns at the end of every financial year can be a problematic and demanding task. Changing government regulations and laws make it even more challenging.

Fortunately, e-filing income taxes with income tax returns (ITR) filing software can ease this task and save your time. Manual efforts are reduced significantly, and chances of error are minimal. Moreover, you can view the records at any time in the software.

What is Income Tax Software?

Income Tax software is a specialized tool designed to simplify and streamline the process of tax preparation and filing for individuals and businesses. It is tailored to help taxpayers accurately calculate their tax liabilities, deductions, credits, and refunds. This happens in compliance with the latest tax laws and regulations.

How Income Tax Software Works?

Income tax software streamlines complex tax procedures. It guides users through a series of questions and data entry fields to ensure all relevant financial information. The software offers features such as automatic calculations, error checks, electronic filing options along with the ability to generate tax forms.

Apart from that, by automating tax preparation tasks, helps taxpayers save time, reduce errors, and maximize their tax returns.

16 Best Free Income Tax Software for CA and Tax Professionals in 2025

| Top Income Tax Software | Best Income Tax Software for |

| EasyOffice | CAs, tax consultants, and advocates across different sectors |

| ClearTax | CAs, tax practitioners, individuals including NRIs and NREs, & SMBs |

| Saral Tax | Chartered accountants, tax professionals, & small business owners |

| Winman GST | CAs, accounting professionals, tax professionals, and SMBs |

| EZTax | Individuals, CA, ICWA, TRP, CMA |

| TurboTax | Tax experts, CPAs, small business owners, and startups |

| TaxPoint | Tax professionals, accounting professionals, beginners |

| TaxSlayer | Tax professionals, individuals like contractors, 1099ers, freelancers |

| H&R Block | SMB, retired individuals, & students. Expert assistance from CPAs |

| TaxRaahi | CA, individuals, companies, tax and accounting professionals |

| TaxCloudIndia | CA, tax professionals like tax consultants, tax return preparers, & lawyers |

| TaxAct | simple filers or those unemployed, dependent, or retired |

| Gen Income Tax Software | CAs, tax professionals, legal/ law firms |

| Chartered Club | Individuals |

| LegalRaasta | Lawyers, SMBs, CAs, start-ups, CS, and accounting professionals |

| CompuTax | SMBs, tax professionals, administration, CAs & finance managers |

There are numerous free and paid IT filing software available in the market for Chartered Accountants (CA) and tax professionals. Some of the best free ITR filing software options are:

EasyOffice

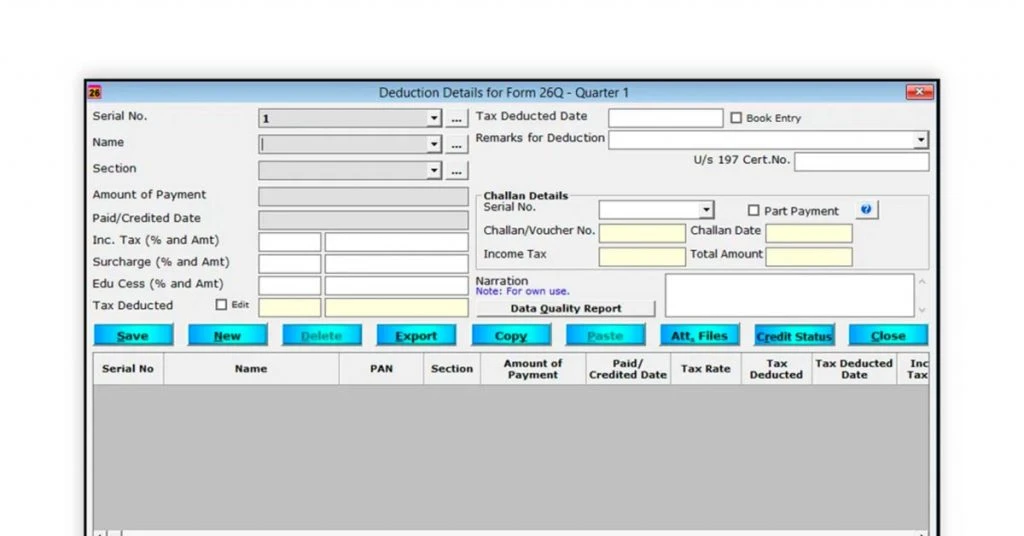

EasyOffice taxation software includes modules for IT returns, audit, CMA, e-TDS, and so on. It has been developed as per the IT Department of India, NSDL, and TRACE requirements.

You can get a summary of online income tax computation as well as the previous year’s income tax. It is possible to make direct e-payments and file e-returns via the software. PAN/TAN of users can be verified online. Office management utilities help in saving time.

EasyOFFICE

Starting Price

₹ 2900.00 excl. GST

EasyOffice Features

- Auto-generation of IT statement

- Can import Form 26AS and data from Tally

- Automatic set-off and carry forward of losses

- Autosave of acknowledgment receipt number

- Pre-validation to spot errors in e-return

- Option to view ITR V

- Data transfer from the previous financial year

- Option to export/ edit files

Free Trial: Not a Free ITR software, but a free trial available

Pros and Cons of EasyOffice

- User-friendly features

- Compliant with government regulations

- No mobile app as of now

Pricing: Pricing starts at INR 2900 for the EasyOffice Light combo package that supports 100 users.

ClearTax

ClearTax income tax software enables users to upload Form 16, and ITR gets prepared automatically. You can add income sources, and deductions and change details at the time of preview. It’s web-based and allows you to file income tax from anywhere, anytime via an internet connection.

The software provides step-by-step guidance on ITR filing. You also get suggestions for tax savings. Further, also download the report to have complete transparency on tax computations.

ClearTax Invoicing Software

Starting Price

₹ 6000.00 excl. GST

ClearTax Income Tax Features

- Auto import income and tax details from the government IT portal

- Multiple Form 16s for job changes

- File returns for multiple years at once

- Save changes and return later

- Prepare revised ITR in case of error

- ITR status tracking

- Supports multiple clients and different income sources

- e-Invoicing

- Expert assistance

- GST calculating and filing

Free Trial: You can try it as a free income tax filing software by creating an account.

Pros and Cons of ClearTax

- Tax-compliant modules

- Secure with bank-grade network security (128-bit SSL) and security audits

- Screenshot-based tutorials and expert support for queries

- Lacks iOS app for businesses

ClearTax Pricing: The pricing for individuals starts at INR 799 and 2999 for business users. However, the ClearTax Android app can be downloaded for free. In addition, a free ITR filing option is available for women, senior citizens, and Indian Defense personnel.

Saral Tax

Saral Tax software is a tax filing and office automation suite that automates ITR related processes like computation and return preparation. For example, you can view the summary of entered data without scrolling.

This ITR filing software has an in-built module that helps tax professionals manage multiple clients’ data. You can also handle non-client contacts and tasks in the same window. As a result, it is easy to manage billing and receipts, documents, and more.

Saral TaxOffice

Starting Price

₹ 8800.00 excl. GST

Saral TaxOffice Features

- Automates daily office tasks for tax professionals

- Integration with IT Department website for easy update of data

- Bulk filing of ITRs

- Data import/ export for filing Income Tax, audit report, and more

- e-payment of taxes via online payment gateway

- MIS reports for transactional insights

- Tax certificate generation

Free Trial: You can request a demo or get a free trial of the latest software version.

Pros and Cons of Saral TaxOffice

- Easy-to-understand workflows with a user-friendly UI

- Security of data

- Prevents data entry duplication with interrelated modules like IT and audit reports

- No cloud support, desktop-based only

- Mobile app only for accounting and billing functions

Saral Income Tax Software Price: Saral income tax software pricing starts at ₹5,500, and Saral Tax Office pricing starts at ₹8,800 for a single user.

Winman GST

Winman GST suite consists of IT software, audit report software, balance sheet software, etc. The software focuses on income tax preparation and tax filing procedures.

It also helps with the generation of GST Returns as per the regulations of the Indian IT department. So, for example, you can generate GSTR-3B, CMP-8, GSTR-1 and get annual returns in GSTR-9, GSTR-9A, GSTR-9C, and GSTR-4.

Winman GST Software

Starting Price

Price on Request

Winman GST Software Features

- Automatic filing of data from balance/computation sheet

- Points out errors to ensure accurate e-filing of ITR

- Automatically connect to IT department upload page

- Can import trial balance from Tally in a click

- Track e-return processing status with one click

- Import of data from 26AS form

- Automatic download and save of ITR V

- MIS Reports

Pros and Cons of Winman GST

- Easy access to GSTR instructions and portal

- Deduplication check

- Password Security

- No mobile app, only on Windows PC

Free Trial: 30 Days

Winman GST Software Price: Winman GST price available on request at techjockey.com.

Suggested Read: How to file GSTR 1 using Tally

EZTax

EZTax free ITR filing software helps with income tax e-filing, TDS preparation, GST accounting, among other services. It enables users to e-file ITR on their own online.

They can also ask for expert assistance at any stage of ITR e-Filing. For CAs and other tax practitioners, this income tax filing software provides the option of bulk e-filing.

EZTax income tax return filing software can create a complex what-if scenario in real-time to display the current refund and possible refund after saving recommendations.

Eztax It Filing

Starting Price

₹ 349.00 excl. GST

EZTax Features

- Client manager to manage all clients from one screen

- Real-time Tax Calculation

- Express Filing to file taxes based on questions

- Auto reads uploaded Form-16, Form 26AS

- Change salary information in case of switching jobs

- Tax Optimizer to save on taxes and increase ROI

- Creative Audit to avoid IT notices in future

- Download customized ITR report

Free Trial: NA

Pros and Cons of EZTax

- Error-free ITR

- Address validation

- Secure File Manager for documents uses an Indian data center

- No separate application for iOS and Mac users.

Pricing: Online self-service with this free income tax filing software is available for free. Expert-assisted filing starts at INR 599.

TurboTax

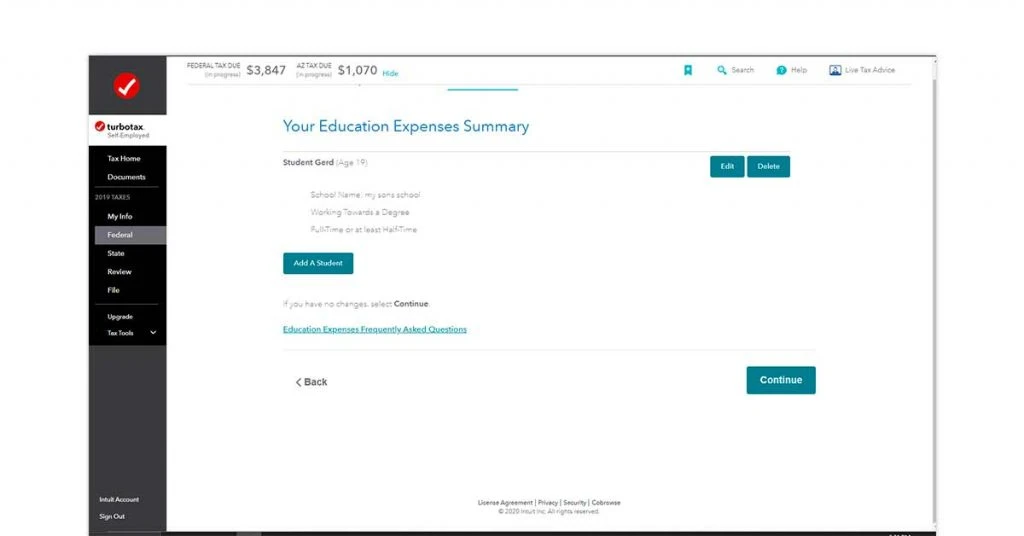

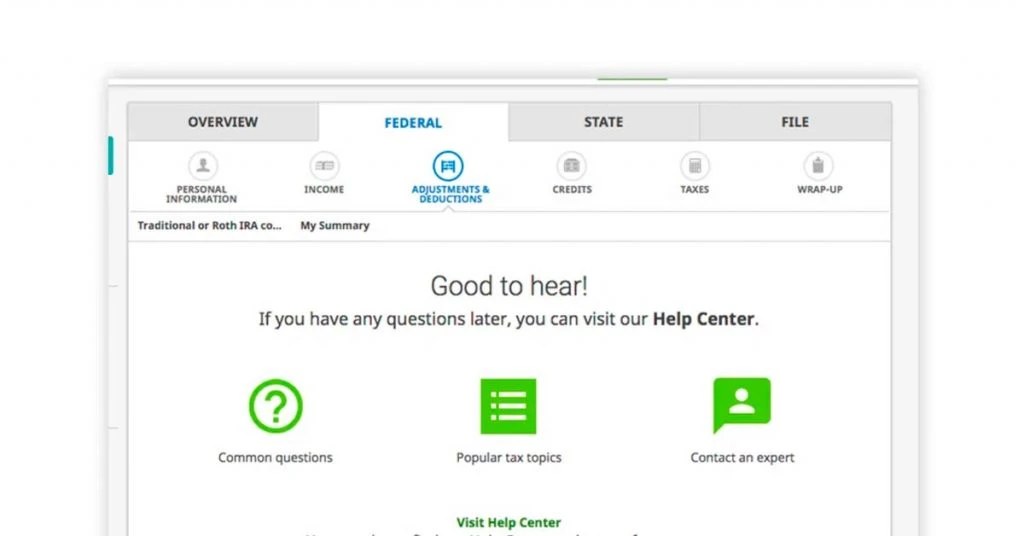

TurboTax ITR filing software free allows users to file their taxes based on their answers to the questionnaire. It imports all the data from W-2 into relevant forms. If you are a US nonresident living in the US, you can still use it.

You can also get the help of a live or dedicated expert. Based on your documents, you get matched with the tax expert suitable for you. Experts can answer any queries and explain everything about a return. Of course, they can file your returns too.

Turbotax Tax Filling Software

Starting Price

$ 129.00

TurboTax Features

- Complete review of a tax return to avoid missing anything

- Can search 350+ tax deductions

- Expense estimator

- Tax bracket calculator

- Audit support from a tax professional

- Documents checklist

- Helps in finding changes in tax deductions and credits

- Email confirmation on tax acceptance

Free Trial: NA

Pros and Cons of TurboTax

- Accurate tax calculations to avoid penalties

- Security with multi-factor authentication and Touch ID

- Mobile apps for both Android and iOS

- Archives your past ITR returns filing

- More features are required for complex financial situations

TurboTax Price: You can start it as a free income tax return filing software and pay only when you file your taxes. Tax calculators are available for free.

TaxPoint

TaxPoint offers its customers a wide range of services, including assistance on taxation matters, business advisory, and financial advisory. This Indian income tax computation software auto-populates the necessary data into the fields when you file returns.

Once you file your taxes with TaxPoint ITR software, you can directly transfer all necessary information for next year’s returns. Contracts and other legal data can also be reviewed for tax considerations.

TaxPoint Features

- Import return data from another online tax prep service

- Tax calculator

- Import W-2 data easily

- Quick refunds and rewards

- International/Local tax planning and compliance

- GST compliance

Free Trial: NA

Pros and Cons of TaxPoint

- Customized services, error checking

- Support via email, phone, live chat

- Filing state returns is not free

Pricing: It’s a free income tax filing software

TaxSlayer

TaxSlayer ensures that taxpayers can maximize the refund as per their income. You can check for errors and missing data before e-filing. After the return is submitted, users get notified once the IRS portal accepts tax returns.

Calculations of the software are always up to date. In addition, integrated bank products help in deducting tax prep fees from refunds so that clients get paid faster.

TaxSlayer Features

- Client portal

- Import data from another tax service of prior year return

- Tax refund calculator

- Autofill income and wages

- Import W-2 Income

- Covers student loan interest and education expenses

- Year over Year comparisons

Free Trial: NA

Pros and Cons of TaxSlayer

- File ITR from any device

- Regular updates on tax laws for accuracy

- Safety and security of tax data via multi-layer authentication

- Support service can get better

Pricing: It is a free income tax return software for simple tax filing (taxable income is low) and includes free state and federal returns. It is also free for military members with an active military EIN.

H&R Block

H&R Block simplifies e-filing tax returns by providing customized tax prep options. It offers questions to help users file their taxes. In addition, you can store returns, receipts, donations, and other tax documents for easy access. You can also file form 1040 and Schedules 1-6.

You can import federal filing data for state taxes calculation. In addition, it can help file local taxes in the US, Canada, Australia, India, Puerto Rico, and Guam report.

H&R Block Online Features

- Personalized tax organizer

- Tax calculator

- Import W-2 data by simply a picture

- Upload last year’s return from TurboTax, Quicken, etc.

- Ensures correct credits, including EIC

- Track return in real-time

- Refund results in real-time

Free Trial: NA

Pros and Cons of H&R

- Multiple safety layers

- In-person audit support

- Additional state fees for features like Audit support

Pricing: This is a free income tax return filing software for online tax filing. Professional services are paid.

TaxRaahi

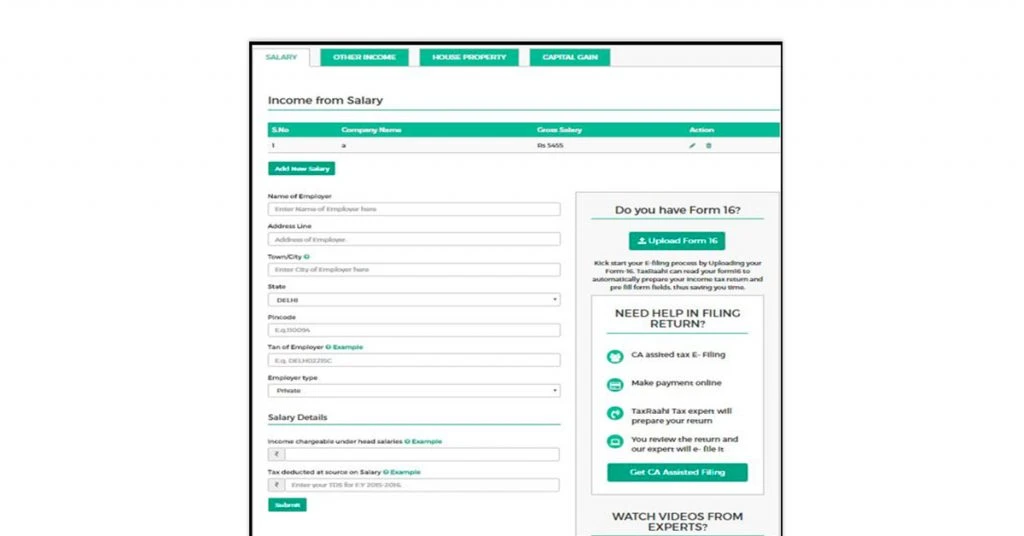

TaxRaahi is a user-friendly taxation software for ITR, TDS, and GST filing. It does not require digital signature certificates (DSC) and tax filing is quite fast.

To ensure correct taxes and deductions, you can calculate income from salary, house property, capital gain, PGBP, and other sources. TaxRaahi ITR follows IT department guidelines to prepare and file returns in ITR 1, ITR 2, ITR 3, ITR 4, and ITR 4S.

Taxraahi ITR

Starting Price

Price on Request

Tax Raahi Features

- View client’s previous return

- Automatic tax computation

- Previous year return import

- Form 16 & 26AS import

- Capital gain calculation

- Store all data at one place

- Can revise returns

- Refund tracking

Free Trial: NA

Pros and Cons of Tax Raahi

- No IT login password needed

- Accurate data

- Does not have a mobile app

Pricing: With this free income tax return software, you can easily file ITR. For expert assistance, pricing starts at INR 471 for a basic package.

TaxCloudIndia

TaxCloud India tax solution automates different tasks during tax filing to save manual efforts. It supports all forms from ITR 1 to ITR 6 and various income sources like salary, property sale, and more.

You can be up to date with the latest tax regulations. In addition, tax professionals can use parallel login so that team members can work on the same client simultaneously.

TaxCloud

Starting Price

₹ 2999.00 excl. GST

TaxCloudIndia Income Tax Features:

- Bulk add clients via XML

- Instant clientele overview to choose a client

- Can drag-drop several Form-16s

- 26AS form fetch from government portal in one click

- Automatic validation of all entries

- Zerodha, CAMs, Karvy integrations for capital gains of clients

Free Trial: 30 days

Pros and Cons of TaxCloudIndia

- e-verification of returns

- Security of passwords by saving them in local machine

- Lacks support

- Setup takes time

Pricing: The software is available for a 30-day trial as free Indian income tax computation software.

Suggested Read: TaxBuddy vs ClearTax: Detailed Comparison of Income Tax Software

TaxAct

TaxAct income tax software supports different types of income status, including retirement, W-2, child tax credits, EIC, and more. Expenses of dependents and full-time students are also covered. You can file the 1040 form and state return as well.

More expenses and income options are covered in paid options. You also get a notification when IRS & state are done with the processing of your returns.

TaxAct Features

- Previous year return import

- Import W-2 data

- Personalized TaxPlan for refund boosting opportunities

- Deduction maximizer

- ProTips service for better tax outcome

- Can calculate depreciation

- IRS refund tracking

Free Trial: NA

Pros and Cons of TaxAct

- Account and technical support

- Intuitive interface

- Limited features with free ITR software version

Pricing: Free ITR software is available for simple filers or those unemployed, dependent, or retired. You can file complex returns and get help with its paid versions.

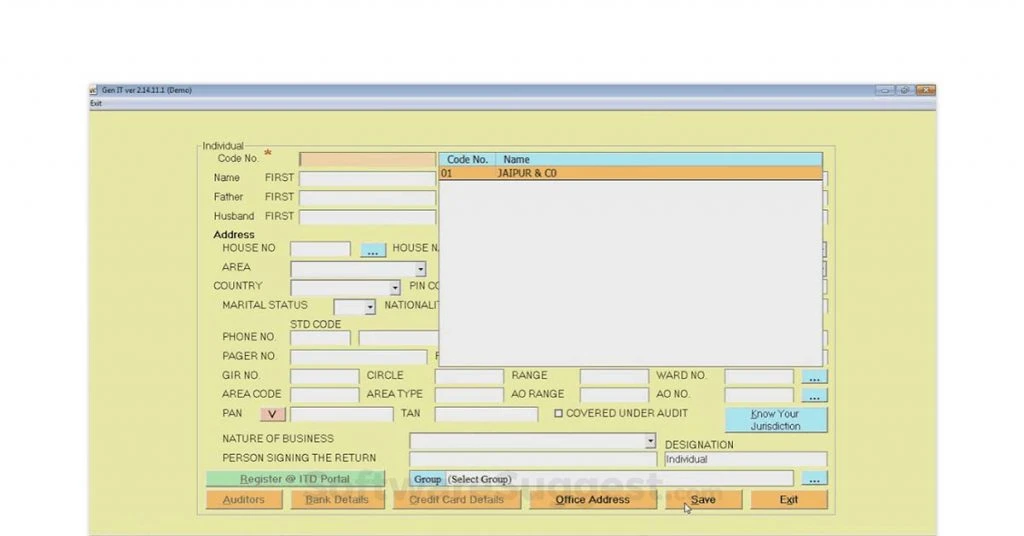

Gen Income Tax Software

Gen Income Tax Software enables e-filing to upload returns directly. You can compute income tax, advance tax, self-assessment tax, and interest. Gen IT includes a wide range of provisions like chapter VIA deductions, setoff losses, arrears, and so on.

You can e-file ITR Forms 1,2,3,4,5,6 and 7. Losses, KVP, and NSC data is automatically carried to the next year from the previous year.

GEN Income Tax

Starting Price

₹ 3500.00 excl. GST

Gen Income Tax Software Features

- Automatic return form generation

- Import data from any tax software in XML

- Bulk e-filing and verification

- IT department web-service for easy upload

- MIS reports like pending returns, refund status, etc.

- PAN correction/ online submission

- Reverse tax calculator

- MAT/AMT computations

- IT portal linking

- Interest calculation

Free Trial: It is a free Indian income tax computation software.

Pros and Cons of Gen Income Tax Tool

- Error-free

- Better Android support than iOS

Pricing: Software pricing is INR 5900 per year at Techjockey. For more details, please contact our sales team.

Chartered Club

Chartered Club by CA Karan Batra is a platform for users to book an appointment and consult for ITR filing. You can discuss your case both remotely and in person.

Once you share the necessary documents, you receive the draft computation of your tax liability. The focus is on reducing your tax liability. If you approve it, your ITR will be filed. TDS certificate facility for NRIs is also available.

Chartered Club Features

- Includes income sources like salary income, rental income, interest income, and capital gains

- Tax advisory before filing

- Tax computations

- Review before filing

- Consultancy throughout the year

Free Trial: NA

Pros and Cons of CharteredClub

- Telephonic support

- Face-to-face discussions

- Not for business income with Books of Accounts, P&L, and Balance Sheet

Pricing: You can get 30 percent off on your first tax consultation appointment. Chartered Club ITR filing service costs INR 9700, of which only 20% needs to be paid in advance.

LegalRaasta

LegalRaasta tax preparation software offers simplified solutions for handling issues related to legal compliance. The software is an e-filing intermediary to be found on the income tax department’s catalogue.

The tax software ensures accurate calculations for e-filing the returns and verifying the data. LegalRaasta is TDS and GST compliant for managing the goods and services tax for individuals and businesses.

LegalRaasta - GST Software

Starting Price

Price on Request

LegalRaasta Features

- Document management for storing tax documents

- Tax filing, liaison, refund assessment & rectification

- High-level encryption and automated backups

- Trademark and patent registration

- Reliable data backups for filing business income and tax returns

- Easy data import from TDS and data files

- Automated TAN and PAN verifications

- TDS computation and OLTAS linking

- FVU format for filing returns

Free Trial: NA

Pros and Cons of LegalRaasta

- Supportive customer services

- Quick support for registering new trademarks

- Easy GST filing

- Excellent documentation support

- No services for FSSAI support

LegalRaasta Pricing: ₹ 668 is the yearly subscription cost of accessing LegalRaasta. More details are available on request.

CompuTax

CompuTax is the ideal software for filing computerized tax returns as well as automating tax-related tasks. The software provides different types of DSC (digital signature certificates). CompuTax online also supports auto-download for ITR 5 along with a locator for identifying errors in e-returns.

CompuTax

Starting Price

Price on Request

CompuTax Features

- Online e-return filing

- DSC registration and bulk refund status

- Data viewing and import form 26AS

- You can add CAs and approve audit reports

- Auto pick intimations and communications

- Linking PAN with Aadhar and generating EVC

- Electronic verification of returns through EVC and Aadhar OTP

Free Trial: NA

Pros and Cons of CompuTax

- Trained technical staff helps with troubleshooting issues

- Best for maintaining taxation database

- Task automation helps reduce the compliance burden

- Data backups created on the cloud

- Customized reports not available

CompuTax Pricing: Price details are available with the vendor on request.

Compare Top 10 Income Tax Software in India Free

Here is a detailed comparison table for multiple tax preparation software like ClearTax, TaxAct India, Quicko, Zoho Books, and more in terms of electronic filing, error checking, importing, security measures, and more.

| Income Tax Software | User-Friendly Interface | Guidance & Support | Importing Capabilities | Security Measures | Error Checking | Electronic Filing | Reviews & Recommendations |

| TaxAct India | Yes | Yes | Yes | Yes | Yes | Yes | Highly recommended |

| ClearTax | Yes | Yes | Yes | Yes | Yes | Yes | Excellent user reviews |

| H&R Block India | Yes | Yes | Yes | Yes | Yes | Yes | Trusted and efficient |

| Quicko | Yes | No | Yes | Yes | Yes | Yes | Positive user experiences |

| Zoho Books | Yes | Yes | No | Yes | Yes | Yes | Highly recommended |

| TaxSpanner | Somewhat | Yes | Yes | Yes | Yes | Yes | Reliable and user-friendly |

| Gen Income Tax | Yes | Yes | Yes | Yes | Yes | Yes | Efficient and cost-effective |

| E-File Income Tax | Mild | Yes | Yes | Yes | Yes | Yes | Positive user feedback |

| Jpat Returns | Yes | No | No | Yes | Yes | Yes | Easy to use |

| QuickITR | Yes | Yes | Yes | Yes | Yes | Yes | Highly recommended |

Features of Best Free Income Tax Software

When it comes to managing and filing your income taxes, using free income tax software can be a cost-effective choice.

Some of the key features that you will find in any free income tax software include electronic filing, guided questionnaires, security measures, mobile accessibility, and more. Let’s read about them in detail.

- User-Friendly Interface: Typically offers a user-friendly interface that simplifies the process of entering your financial information like income, deductions, etc.

- Guided Questionnaires: Provides guided questionnaires to help users identify potential tax deductions and credits.

- Importing Financial Data: Allows users to import their financial data directly into the software while saving time and reducing manual entry errors. This feature is especially useful for individuals with multiple income sources, investment accounts, etc.

- Error Checking: Typically includes error-checking mechanisms to help users identify and correct mistakes or risks in the audit before filing their taxes.

- Electronic Filing: Most of the software allows users to electronically file state tax returns. This helps streamline the submission process.

- Security Measures: Top income tax platforms prioritize data security. It uses encryption and other protective measures to safeguard users’ sensitive financial information.

- Updates for Tax Law Changes: Such solutions are frequently updated to show changes in tax laws and regulations. This ensures that users have access to the most current tax rules and requirements.

- Integration with Financial Software: This software integrates seamlessly with popular financial and accounting software to efficiently transfer relevant financial data.

Free income tax software offers a comprehensive array of features designed to simplify the tax preparation process, maximize deductions, and ensure accuracy when filing tax returns.

Who Should Use Income Tax Software?

Income tax software is a valuable tool for individuals and businesses that offer a range of benefits. The key entities who leverage software include individual taxpayers, freelancers, self-employed individuals, property owners, SMB owners, investors, and more.

- Individual Taxpayers: Individuals with tax situations and limited investments or deductions, can benefit from using income tax software. It provides an efficient way to file taxes without the need for professional assistance.

- Freelancers and Self-Employed Individuals: Freelancers, independent contractors, and self-employed individuals often have complex tax situations involving business expenses, income from multiple sources, and self-employment taxes. It can help navigate these complexities and maximize deductions.

- Small Business Owners: Sole proprietors, partnerships, and small businesses use tax preparation software designed for businesses. The software offers features that cater to business tax needs, including income and expense tracking, depreciation calculation, and business-specific deductions.

- Rental Property Owners: Individuals who own rental properties use software with features geared towards rental property income and expenses. This helps streamline the process of reporting rental income, deductions, and depreciation.

- Investors: Investors with diverse investment portfolios, including stocks, bonds, mutual funds, and real estate investments, benefit from using tax preparation software. The software helps calculate capital gains, dividends, and investment-related deductions accurately.

- Retirees: Retirees with various sources of income, such as pensions, social security benefits, investment, and retirement account withdrawals benefit from this software designed to address specific retirement scenarios.

- Tax Preparers: Professional tax preparers and accounting firms often use income tax software to process tax returns for their clients. Specialized tax preparation software offers advanced features and robust support for tax professionals.

Income tax software caters to a diverse range of individuals and businesses with varying tax situations. Whether it’s simplifying the tax preparation process for individuals or offering specialized features for businesses and tax professionals, tax preparation software helps manage all tax obligations.

How to Choose Best Income Tax Software Online?

Selecting the best income tax software online is important for managing your tax filing process. One should consider the following factors to make an informed decision while choosing the best software for filing the income tax:

- Tax Situation Assessment: Begin by assessing your tax situation. Determine whether you have a straightforward tax return or if it involves complexities like self-employment income, investments, rental properties, and business ownership. Understanding your tax situation will help identify the features and functionalities you require from the software.

- User-Friendly Interface: Look for tax preparation software with a user-friendly interface and intuitive navigation. A clear and easy-to-use interface can simplify the tax preparation process and reduce the potential for errors.

- Guidance and Support: Consider whether the software vendor provides guidance and support tailored to your specific tax needs. Some software offers guided questionnaires and expert support to help identify applicable deductions and credits based on your financial situation.

- Importing Capabilities: Check for the ability to import your financial data directly into the software. This feature can save time and reduce errors, especially if you have multiple income sources or financial accounts.

- Security Measures: Ensure that the tax software for tax preparers prioritizes data security. Look for software that supports encryption and other protective measures to safeguard your sensitive financial information.

- Error Checking: Look for robust error-checking mechanisms within the software. The ability to identify potential errors and provide suggestions for correction can help minimize the risk of inaccuracies in your tax return.

- Electronic Filing Options: Consider whether the software offers electronic filing options for tax returns. This can streamline the submission process and expedite potential refunds.

- Mobile Accessibility: Consider tax software for tax preparers that offers mobile accessibility through dedicated mobile apps or responsive web interfaces.

- Reviews and Recommendations: Research and read user reviews and recommendations for various income tax return software options. Consider feedback related to ease of use, accuracy, customer support, and overall satisfaction with the software.

By considering these factors, you can make an informed decision when choosing the best income tax software online.

What is ITR Form?

ITR form is essentially a tax form used to file income tax with the Income Tax Department. Taxpayers file all information about their income and applicable taxes in the ITR form. For now, the income tax department has notified seven ITR forms mainly ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7.

The law requires all taxpayers to file income tax returns annually. ITR is filed against the income businesses or individuals generate during a given assessment year through all sources such as regular income, dividends, interest, capital gains, etc. Taxpayers must file their returns within the specified date, which is July, 31 for this year.

In case the tax return shows that a taxpayer has paid excess tax during a given year, the taxpayer/assesses is eligible for a tax refund based on the department’s calculations.

The taxpayer’s sources and amount of income along with his/her income category (individual, business, etc.) decide which ITR form they are eligible to fill.

Identify the Suitable ITR Form

A significant step towards filing income tax return is to identify the tax return form that is applicable for an individual taxpayer, as below:

# ITR-1 (SAHAJ)

- Resident and ordinarily resident (ROR) individuals with total income of ₹50 lakh and below,

- Having salaried income,

- Owning a residential property,

- Agricultural income up to ₹5,000,

- Income from other sources,

- Despite their source or quantum of income, non-residents cannot file ITR-1.

# ITR-2

Individuals who do not have income from profits and gains of business or profession (who cannot use ITR-1) can use ITR-2.

# ITR-3

This is apt for individuals who have an income from profits and gains of profession or business.

# ITR-4(SUGAM)

- It is suited for individuals, and firms (other than LLPs) that are residents,

- have total income ₹50 lakh and below

- have income from business and profession computed under the presumptive taxation scheme.

Conclusion

Selection of software should be made on work requirement. If an unpaid software has the features you need, consider choosing that. Get trained on all features of the software you choose if you want its best use. It will prevent bad outcomes.

Above all, the ITR forms for the assessment year 2021-2022 have been revised. It is a mandate for everyone to understand the new form requirements before filing their income tax return. Be very careful while filling your forms to avoid any complications or legal implications.

Income Tax Software FAQs

What is the last day of income tax return filing in 2021?

Income Tax Return (ITR) Filing the last date is September 30, 2021.

What are the advance tax due dates in 2021?

In the financial year 2021, you must pay 15% of tax liability by 15th June every year, 45% by 15th September, 75% by 15th December, and 100% on or before 15th March.

Which versions of ITR utilities are supported in the FY 2021-22?

In FY 2021-22, a common offline utility for filing income-tax returns ITR 1, ITR 2, ITR 3, and ITR 4 is available. In addition, a common offline utility for filing Income-tax returns ITR 5, ITR 6, and ITR 7 for the FY 2021-22 will be available soon.

Which is the best software for filing income tax returns?

The best software for filing income tax returns depends on individual preferences and specific tax situations. Some popular options include TurboTax, H&R Block, TaxAct, and TaxSlayer. Each of them offers unique features and user experiences to cater to the specific needs of taxpayers.

What is the most popular software used for filing taxes?

The most popular software used for filing taxes includes TaxSlayer, H&R Block, TurboTax, TaxAct, and more. These platforms offer user-friendly interfaces, accurate calculations, and comprehensive support. These make them go-to choices for individuals and businesses seeking ideal tax filing solutions.

What is the best app to do your income tax?

Choosing the best app for doing income taxes depends on individual needs, but popular options like TurboTax, H&R Block, and TaxAct are known for their user-friendly interfaces, accuracy, and robust features. They simplify the tax filing process for individuals as well as businesses. These apps offer convenience, guidance, and timely updates to ensure a smooth tax filing experience.

What is the best tax system to use?

The best tax system to use depends on various factors such as individual tax situations, preferences, and specific needs. Popular choices include TurboTax, H&R Block, TaxAct, etc. It's important to consider ease of use, accuracy, and customer support when selecting the most suitable tax system.

What is ITR Software?

ITR software refers to software designed to facilitate the preparation and filing of Income Tax Returns (ITR) in compliance with tax laws and regulations. These specialized applications streamline the tax filing process for individuals and businesses with features such as automated calculations, error checks, and electronic filing options. These features ensure accurate and efficient tax return submissions.

Ayushee is currently pursuing MBA Business Analytics from SCMHRD, Pune with a strong background in Electronics and Communication Engineering from IGDTUW. She has 2 plus years of full-time work experience as an SEO content writer and a Technology Journalist with a keen interest the amalgamation of business and... Read more