Comparison of 10 Best Accounts Receivable Software for Businesses

Accounts receivable (AR) management is vital to the success of any business, small or large. When done efficiently, it helps mitigate the chances of overdue payments or non-payments by customers for the services or goods you provide them. This helps improve cash flow and hence, the company’s financial position.

Accounts receivable software can streamline AR processes. It is a great choice for remote teams and medium and large businesses to centralize, analyze, and summarize customer data. It helps avoid confusion with spreadsheets and make informed decisions. This article discusses some of the leading AR software available on the market.

What is Accounts Receivable Software?

Accounts receivable software is a program that enables businesses to manage and automate their invoicing, payment collection, and other transaction-related processes. Depending on your needs, deployment of the software can be on-premises, software as a service (SaaS), or cloud-hosted.

Apart from financial and accounting capabilities, some accounts receivable solutions also offer additional features like inventory management and custom branding. The software is beneficial to growing companies as it helps in meeting their financial obligations and improving their market position.

Components of AR Software

Main components of an accounts receivable solution include:

- Credit collections management

An accounts receivable solution allows you to optimize the collections process to reduce DSO (days sales outstanding) and improve relationships with your customers.

- Invoicing

Create a billing structure as per your requirement and send accurate invoices containing different prices, tax rates, and discounts on time.

- Payments and payment gateway

You can accept customer payments made through credit cards, ACH, debit cards, etc., after integration with a payment gateway. It also ensures regulatory compliance (like PCI-DSS) and streamlines account reconciliation.

- Receivable analytics and reporting

With an accounts receivable solution, you can gain an in-depth understanding of the financial health of your business through reports and dashboards. You can also make precise cash forecasting through insights.

- Claims & deductions management

Using an accounts receivable system, you can boost your profitability by identifying and resolving issues related to invoices and short payments.

- Customer portals

You can reduce the need for customer service by providing self-service portals to customers where they have real-time access to their payment due dates, order history, and more.

Suggested Read: Best Free and Open Source Accounting Software

Comparison of 10 Best Accounts Receivable Software for Businesses

Here are some of the best accounts receivable software options that you can select from for your business depending on your purpose:

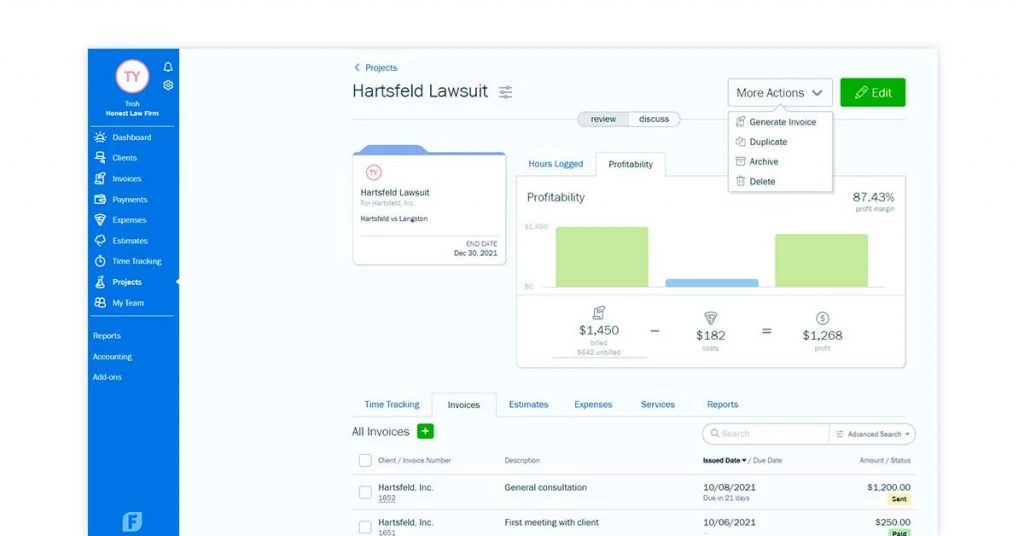

FreshBooks

FreshBooks is a highly popular cloud-based accounting software that enables small businesses to automate their accounts receivable (AR) and accounts payable (AP) processes.

You can track billable hours, create invoices, and offer multiple payment methods to customers. It also integrates with other accounts receivable software like FundBox and Tallyfor.

Freshbooks

Starting Price

$ 6.30

FreshBooks Features

- Automatic reminders for late payment

- Financial reporting

- Self-serve client portal

- Multi-currency billing

- Automatic billing of late fees

FreshBooks Pricing: This accounts receivable system offers a 30-day free trial. Pricing is available on request at techjockey.com.

CollBox

CollBox accounts receivable solution connects to your existing cloud-based accounting software such as Xero and Sage accounting tool to identify outstanding invoices.

You can view all the past-due invoices and choose what to recover in a few clicks. It is commonly used by marketing agencies, construction companies, field services, and so on.

CollBox Features

- On-demand service of AR experts & collection agencies

- Past due account overview

- Collection offers

- Live Status tracking

Pricing: Sign up is free. You can get Collect plan by CollBox without any upfront costs if you have invoices that have crossed 90 days past the due date.

Rate starts at 25% on successful collections. For recently due invoices, you can purchase Assist plan at INR 18766.13 per month.

Chaser

Chaser AR automation software aims to help you maintain customer relationships while recovering your debts. You can sync your cloud accounting software and submit several collection cases.

It also keeps track of all your customer communications and integrates with ZohoBooks, QuickBooks Online, FreshBooks, etc.

Chaser Accounts Receivable Software Features

- Account management

- Automated payment invoice reminders

- Domain verification

- AR data import

- Payment portal

Pricing: It has three plans, namely, Basic, Standard, and Enterprise. You can get a 14-day free trial before purchase. Pricing starts at INR 3001 for up to 50 invoices per month.

YayPay

YayPay AR collections solution is used by businesses for automating routine tasks. It ensures quick payment and helps track accounts receivable via reports.

The software uses machine learning (ML) to enable better planning by predicting payment behavior. It integrates with ERP, billing, accounting, and CRM apps to consolidate entire accounts receivables information.

YayPay Features

- Communications history

- Customizable credit scorecards

- Flexible payment options

- Business intelligence (BI) based reporting

- Collections management

YayPay Pricing: You can get a demo of this accounts receivable system and pricing details on techjockey.com.

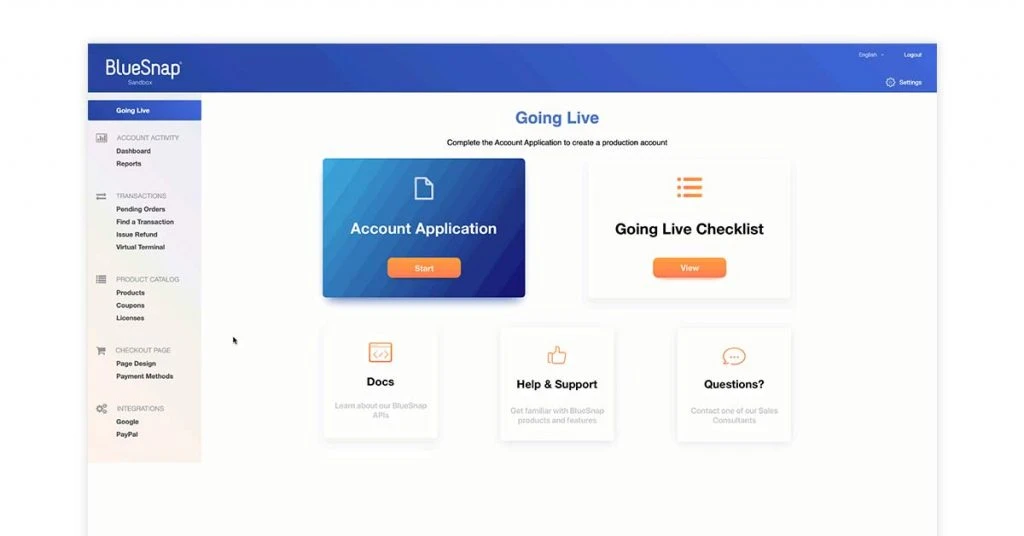

BlueSnap

BlueSnap software enables businesses to create billing structures as per their requirements. Late fee is determined based on custom rules set by the user and applied accordingly. It is pre-integrated with software like NetSuite, QuickBooks, and Microsoft Dynamics.

BlueSnap Features

- Self-service customer portal

- 100+ payment types

- WYSIWYG invoice editor

- eSignatures for quotes, contracts, etc.

BlueSnap Pricing: You can contact their sales team for pricing information.

Fundbox

Fundbox AR financing software connects to your accounting software and automates the lending process through machine learning (ML). You can opt for a credit line to fund ongoing expenses and a term loan for a one-time investment.

It also enables you to simulate scenarios by including potential transactions. You can use Fundbox iOS or Android app for funding on the go.

Fundbox Features

- Quick approval decisions

- Customized cashflow predictions and alerts

- Standard security protocols

- Automatic repayments

Fundbox Pricing: Fee is charged at the rate of 8.99% for 24-week and 4.66% for a 12-week repayment plan. It is for the US companies with annual revenue over INR 75.08 lakhs and 600+ FICO score.

The charge for term loan offering (beta) is 8.33% for 24-week terms and 18% for 52-week terms.

Xero

Xero accounting solution enables businesses to streamline AP and AR processes. This AR software allows real-time accounts receivables tracking and transactions in over 160 currencies across the world.

You can use pre-filled information based on inventory to quickly create orders and invoices. Moreover, you can view the details of invoices and payments in a single location.

Xero Accounting Software

Starting Price

$ 29.00

Xero Accounts Receivable System Features

- Automatic payment reminders

- Payment via GoCardless, Stripe, etc.

- Bank reconciliation

- Automatic sales tax calculations

- Analytics for financial health

Xero Pricing: It offers a 30-day free trial. There are three plans-Starter, Standard, and Premium. Pricing is available on request at techjockey.com.

Wave

Wave accounting is a web-based invoicing and accounting solution that enables businesses to create invoices through customizable templates and send them in various currencies.

Payment terms can be set as per your requirement. You can also share statements in case of overdue customer accounts. This AR software works on Windows, Mac, Android, and iOS.

Wave Accounting

Starting Price

$ 16.00

Wave AR Software Features

- Estimate to invoice conversion

- Automatic payment reminders

- Customer transaction history

- Tracking payments and overdue invoices

- Automatic payments for recurring invoices

Wave AR Solution Pricing: It is completely free accounting software. There is no setup or monthly fee. You can get it from techjockey.com.

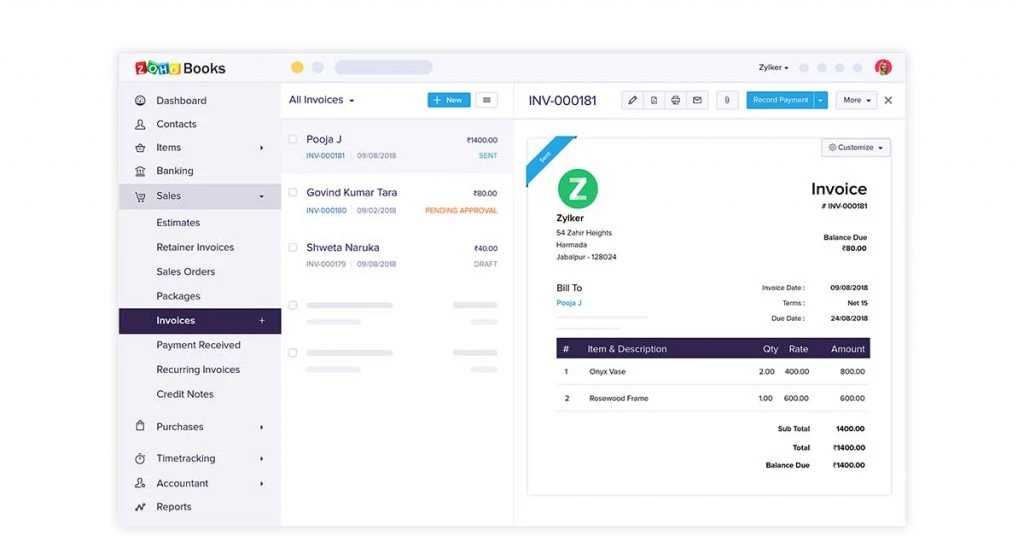

Zoho Books

Zoho Books is a complete accounting solution that enables businesses to send estimates, create invoices, and manage payments. You can verify transactions before approval to avoid errors.

The dashboard displays details like total sales, receivables, etc. Activity log report ensures that you stay ready for audit always.

Zoho Books

Starting Price

₹ 899.00 excl. GST

Zoho Books Features

- Bank reconciliation

- Auto-collect recurring payments

- Digital signature to prevent tampering

- Automated payment reminders

- Supports payment gateways like PayPal, Stripe, PayTabs

ZohoBooks Pricing: It offers a free plan for businesses with annual revenue below INR 37,55,375. You will also get 14-day free trial for premium plans.

Three paid plans are offered, namely, Standard, Professional, and Premium. Pricing starts at INR 750.53 per organization per month when billed annually.

Pipefy

Pipefy enables businesses to automate recurring invoicing and control collections to improve cash flow. You can also customize the dashboard to track the AR process.

It offers integration with QuickBooks Online, NetSuite, FreshBooks, etc. With customizable analytics, you gain actionable insights to improve your cash flow.

Pipefy Features

- Shared inbox for centralizing emails

- Invoice status tracking

- SLA alerts

- Invoice due date reminders

Pipefy Pricing: It has a free plan for small teams. Paid plans include Business, Enterprise, and Unlimited options starting at INR 1350.88 per user/month.

Benefits of Accounts Receivable Software

Some of the major benefits that an accounts receivable system offer are:

It automates repetitive workflows and calculations, resulting in reduced manual errors.

AR software can help you identify and close invoices faster, thereby improving your cashflow position.

Automating the billing process and e-invoicing can help you save time through short payment cycles. It also saves money usually spent on printing and sharing physical copies of documents.

By using communication tools offered with accounts receivable software, you can enhance business interactions.

You can make better decisions in terms of investments, invoice collection, and more as you have more control over capital.

It helps track the payment status of all your customers and automates the process of payment reminders to them.

Timely invoicing reduces the chances of additional costs for the customer due to late payments, which improves customer satisfaction.

You can generate credit reports and segment customers based on risk estimation and decrease credit risk.

AR software helps minimize chances of invoice related disputes and allows collectors to settle the existing ones quickly.

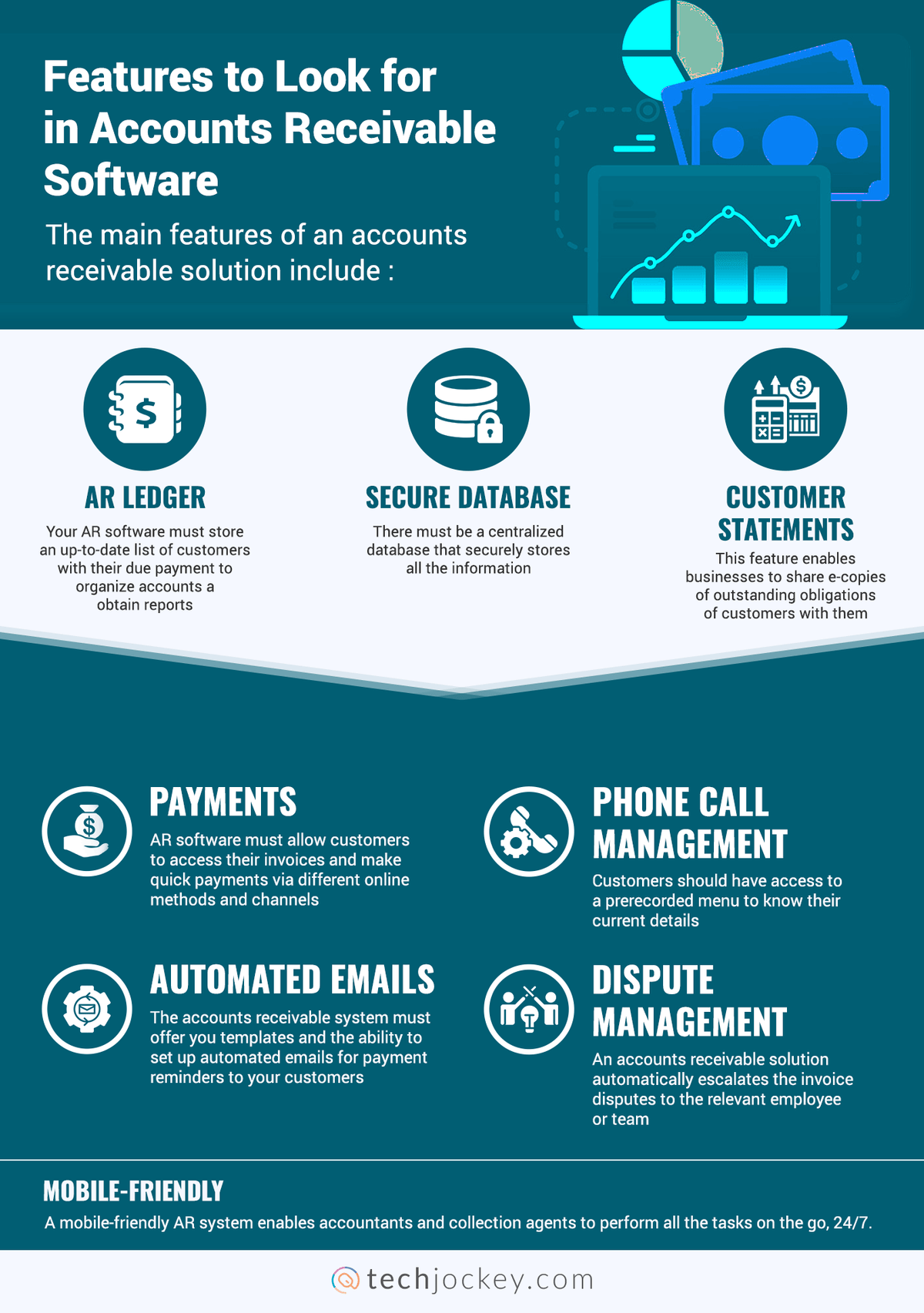

Features to Look for in Accounts Receivable Software

The main features of an accounts receivable solution include:

AR Ledger: Your AR software must store an up-to-date list of customers with their due payment to organize accounts and obtain reports.

Secure database: There must be a centralized database that securely stores all the information. The software must also offer search filters and advanced categorization options to make data easily accessible.

Customer Statements: This feature enables businesses to share e-copies of outstanding obligations of customers with them. By avoiding manual entries, you reduce the chances of mismatches.

Payments: AR software must allow customers to access their invoices and make quick payments via different online methods and channels.

Phone call management: Customers should have access to a prerecorded menu to know their current details. The software must transcribe and record the calls made by collectors to the customers for payments to avoid hassles later.

Automated emails: The accounts receivable system must offer you templates and the ability to set up automated emails for payment reminders to your customers. You must be able to attach invoices, purchase orders, statements, and other documents to the emails.

Dispute management: An accounts receivable solution automatically escalates the invoice disputes to the relevant employee or team. It must also track all the disputes to help you act on the frequently occurring ones. This allows businesses to quickly convert receivables to cash.

Mobile-friendly: A mobile-friendly AR system enables accountants and collection agents to perform all the tasks on the go, 24/7.

Considerations When Buying Accounts Receivable Software

When buying an accounts receivable system, consider the following factors:

Costs: Depending on the purpose and your budget, you can choose the type of AR software you want. Some accounting systems include numerous functionalities to streamline accounts receivables processes, but you might not need them.

Quick processing: Your accounts receivable system must be capable of handling the volume of invoices and data generated from your business. It must centralize all the information and improve the speed of all processes from invoice receipt generation to approval.

Online payments: The software must support multiple digital payment options and modes so that customers can quickly pay through different channels.

Predictive cash forecasting: Your AR system must use reliable algorithms to make predictions based on your transaction history.

Security: Since financial information is highly sensitive, the accounts receivable solution must have bank-grade security to prevent unauthorized access to customer data.

Integration capabilities: The accounts receivable solution must integrate with popular accounting, productivity, and other tools used by your teams.

Compliance: Your accounts receivable system must comply with government laws and regulations in your region to help you avoid penalties.

FAQs

How does accounts receivable software help reduce the invoice to cash cycle?

An accounts receivable software automates the creation and sharing of invoices. It also allows automatic sending of payment reminders before the due date, which helps reduce invoice to cash cycle.

How does accounts receivable software help reduce the labor cost?

Companies usually employ a specialist or an entire team to handle accounts receivable, depending on the business requirements. Accounts receivable software automates manual tasks and speeds up the processes, which helps reduce the cost of hiring.

What are the three types of accounts receivables?

The types of accounts receivable are notes receivable, accounts receivable, and other accounts receivable. Notes receivable are a result of short-term loans; accounts receivable arises from credit sales. Other receivables include salary receivables, tax refunds, etc.

Related Categories: GST Software | Expense Management Software | Debt Collection Software | Financial Management Software

Ayushee is currently pursuing MBA Business Analytics from SCMHRD, Pune with a strong background in Electronics and Communication Engineering from IGDTUW. She has 2 plus years of full-time work experience as an SEO content writer and a Technology Journalist with a keen interest the amalgamation of business and... Read more